Category Archives: Big Banks

Top Economist La Rouche Passes

LaRouche Was Opponent of Crooked Banking System

This obituary was originally published by EIR magazine. See also, “A Talent Well Spent.”

Lyndon H. LaRouche, Jr., the American economist and statesman who compiled, between 1957 and 2007, the most accurate record of economic forecasting in the world, passed away on February 12, 2019. The author of thousands of articles and over 100 books and book-length pamphlets and strategic studies, LaRouche was one of the most controversial political figures in all of American history.

One reason for this was LaRouche’s proud, vigorous, and enduring Presidential campaign, 1976–2004, to re-establish American Constitutional self-government following the 1963–1968 assassinations of John F. Kennedy, Malcolm X, Martin Luther King, Jr., and Robert F. Kennedy. Another reason was his successful establishment of an independent news service and intelligence gathering capability that allowed him and his associates an unfiltered evaluations capability, which equipped them to accurately report the true state of the American economy, and often, the true nature of otherwise mysterious American and international political processes.

LaRouche also created an international philosophical association, on the basis of re-creating the knowledge about the millennia-old controversy between the Platonic tradition and the school of Aristotle, the fight between the republican model of state and the oligarchical system of empire.

LaRouche’s reach outside the United States was the result of his successful recruitment of hundreds of politicized students from many nations, particularly in Europe, Canada, and Central and South America. This self-selected intelligentsia gave him the power to originate and implement policy shifts through the deployment of modest but well-trained and extremely well-informed units that catalyzed much larger forces in various nations to sometimes act as “one mind across many continents.”

LaRouche was known for his insistence that each citizen of the United States, as well as citizens of any sovereign nation, have the responsibility to educate themselves on the crucial matters of policy that affect the future of their nations, and of humanity; to propose and defend only those policies that “promote the General Welfare of ourselves and our posterity;” and to defeat predatory financial measures enacted in the pursuit of racialist depopulation policies, sometimes disguised as “environmentalism” or “sustainable development” aimed particularly at the nations of Africa, Asia, and Central and South America.

Though prominent international persons and institutions have recently begun reporting about LaRouche, despite his having been one of America’s most prolific writers, no “major media source” has yet dared to quote Lyndon LaRouche’s actual views on any policy matter for which he was noted. This fear of LaRouche is notable, but not new. It was always true that the power of the ideas of LaRouche, as much as, or even more than the person of LaRouche, were deeply feared by his opponents. That fear will not abate with his physical demise.

LaRouche’s Four Laws, his proposal for a United States-Russia-China-India Four Powers Agreement, his invention of the 1983 Strategic Defense Initiative (SDI) announced by then-President Ronald Reagan, and his unique five-decade advocacy of thermonuclear fusion power cannot be allowed to be mentioned by “mainstream media” today, even upon the occasion of LaRouche’s death. Were the American people to now know about these policies, and therefore what they had been denied by the decades-long enforced conspiracy of silence around LaRouche, particularly during the financial crises and useless predatory wars of the past 15 years, they would immediately conclude that someone has been trying very hard all these years to keep them away from Lyndon LaRouche’s ideas.

“He’s a bad guy, but we can’t tell you why” will no longer suffice as an explanation for these people, as to why they should not, even now, know “who Lyndon LaRouche is.” In successfully breaking the confines of fake news at this moment, the real Lyndon LaRouche can finally be heard and become known. To that end, the following brief, very incomplete account of his life and work is supplied.

The Development of a World Statesman

LaRouche established himself over more than four decades as the foremost enemy of the British Imperial System, in both its pre-World War II and ongoing post-war Commonwealth incarnations. LaRouche’s service in World War II, particularly in the Burma theatre was personally decisive. “It was the experience in Calcutta, in 1946, which defined my principal lifelong commitment, that the United States should take postwar world leadership in establishing a world order dedicated to promoting the economic development of what we today call ‘developing nations,’ ” LaRouche wrote in his autobiography, The Power of Reason: 1988. LaRouche began to do battle with the “political economic theorists” and slave-traders of the modern-day British East India Company, whose theories dominated American university Economics departments in the aftermath of World War II.

LaRouche fiercely opposed the conception of man-as-a-beast advocated by Francis Bacon, Thomas Hobbes, Parson Thomas Malthus, and John Locke. Instead, LaRouche re-established the science of physical economy in the United States, a science invented in 1672 by the German philosopher Gottfried Leibniz, inventor of the calculus and co-inventor of the steam engine. Through an intensive period of study between 1948 and 1952, LaRouche advanced his independent studies in physical science in order to develop his method of economic forecasting. The 1983 book, LaRouche: Will This Man Become President? states: “What LaRouche first recognized during 1952, was that by adopting a conception of energy which is fully consistent with [bernhard] Riemann’s 1854 dissertation, ‘On the Hypotheses Which Underlie Geometry,’ it is possible to measure both technology and economic growth in terms of energy so defined. In LaRouche’s work, economic value—real economic growth—is measured primarily in terms of increases of the potential relative population density of society.”

LaRouche, however, looked at all of his work on physical economy as the specific expression of a deeper epistemological task. In his 1988 article “Beethoven as a Physical Scientist,” LaRouche writes:

“My most important discoveries, in every field which I have contributed, are based upon my successful refutation of the famous Kantian paradox reasserted in Immanuel Kant’s Critique of Judgment. Kant asserted two things of relevance here.

“First, he insisted that although creative processes responsible for valid fundamental scientific discoveries exist, these processes themselves are beyond all possible human understanding. That I proved to be false, and from that proof developed an approach to intelligible representation of those creative processes, and hence the implicit measurement of technological progress as such.

“Second, on the basis of the first assumption, Kant argued that there were no intelligible criteria of truth or beauty in aesthetics. The toleration which has been gained so generally by all modern irrationalism in matters of art, has depended upon German and other acceptance of this thesis on aesthetics advanced by Kant and Friedrich Carl von Savigny later.”

The prolific nature of Lyndon LaRouche’s writings, in the fields of music, economics, history, language, and the physical sciences, inspired many collaborations and exchanges with people throughout the world. LaRouche, importantly, was a statesman—not a politician—a practitioner of statecraft, in the Socratic-Athenian sense. He established organizations through teaching, starting with a several-part lecture series in 1966, through which he advanced and debated his method of economic forecasting, especially on university campuses. Many first encountered LaRouche on one side of a debate, held with campus economic and political authorities of the 1970s. This stopped after LaRouche’s famous 1971 debate with economist Abba Lerner, who lost by admitting that if the austerity policies of German Finance Minister Hjalmar Schacht had been implemented in the 1920s, “Hitler would not have been necessary.” Within months, no one could be found to debate LaRouche, and no such debates ever again occurred.

LaRouche’s lectures on what were at the time called “dialectical economics,” were precisely that—dialogues between LaRouche and philosophical, economic and scientific figures from history, portrayed by him with storyteller precision, always done without notes, and often done without any books at all. Students were supplied with an extensive syllabus of reading material, with suggested readings detailed week by week. One student recalled that “passages were referred to from a work like Kant’s Critique of Practical Reason, for example. You would be told to read it. If you did so, and came to the class the next week, he would first describe what his idea was of the passage, which was persuasive as well as accurate. He would then proceed to destroy it piece by piece, and because you had read it, and accepted it, you got to discover the fallacies lurking at the bottom of your own mind. He demonstrated to you the difference between reading and thinking. They weren’t classes: they were soliloquies. And that’s how we got interested.”

LaRouche’s primary organization was the National (later International) Caucus of Labor Committees, a philosophical association organized as a “system of conferences,” usually held twice yearly. From this association sprang many other organizations, such as the Fusion Energy Foundation, the U.S. Labor Party, the National Democratic Policy Committee, the Anti-Drug Coalition, and others. LaRouche also founded and worked with organizations in France, Germany, Italy, Sweden, Canada, Denmark, Mexico, Colombia, Peru, Australia, and many other nations.

In December of 1977, LaRouche married Helga Zepp of Germany, later the creator of the Schiller Institute, a policy institution for the promotion of statecraft and a renaissance of Classical culture.

“In the fall of 1977, I suggested that we marry…. I was a little surprised, but pleasantly, when she agreed…. There was nothing ordinary about the lives of either of us, nor was it ever likely to be otherwise. We married in Wiesbaden on December 29, 1977. The service was in German; the official of the Standesamt asked me in German, if I knew what was happening. There was laughter about that question among my friends for weeks afterward.”They remained married for 41 years.

The combative nature and polemical style of the campaigns, electoral and non-electoral, of LaRouche and his associates were unique in American political life in the 1970s, 1980s, and 1990s. LaRouche’s 1976 half-hour broadcast, “Emergency Address to the Nation,” was the first time an independent candidate had ever purchased that quantity of television time in a U.S. federal election. LaRouche appeared on television fifteen times during the Presidential election of 1984 in 30-minute segments, virtually inventing what would later be imitated as the “infomercial.” The LaRouche Presidential candidacies, and the candidacies of his associates, including the running of 1,000 candidates for office in 1986 alone, both terrified LaRouche’s opponents in the United States, and inspired others to have the courage not merely to run for office, but to support policies designed to benefit all of humanity, not merely “their local mud-hole.”

One such policy was the International Development Bank (IDB), a 1975 LaRouche proposal to replace the International Monetary Fund, and to develop what was then termed “the Third World” through providing for the export of, not only American-built technology, but entire cities. These cities were to be built as training sites for the rapid development of the skills of developing-sector populations, enabling them to create their own “full-set” economies, rather than become debt-slaves, as in fact occurred.

Persons such as Frederick Wills, the former Foreign Affairs Minister of Guyana, advocated LaRouche’s IDB proposal in a 1976 session of the United Nations. Mexico’s President José López Portillo and India’s Prime Minister Indira Gandhi met with Lyndon and Helga LaRouche and adopted aspects of his proposals, many of which were presented as book-length treatments, such as “Operation Juárez” for Mexico and “The Industrialization of India: From Backwardness to Industrial Power in Forty Years” and a “A Fifty-Year Development Policy for the Indian-Pacific Oceans Basin”—all papers written by LaRouche in the early 1980s, and whose central outlook is still current, not only for today, but for the next decade or more.

The unorthodox method for dispersing these ideas advocated by LaRouche was Socratic: talking to people one on one. This daily street organizing occurred at unemployment centers, post offices, airports and traffic intersections, street corners, downtown areas and shopping malls. This direct contact with the American population resulted in LaRouche having a better reading on what was happening in the United States “from on the ground” than any other political force in the country. Corrupt elements of the Justice Department, and “quasi non-governmental organizations” who were given the green light to illegally disrupt the Constitutionally-guaranteed right of LaRouche’s associates to organize were forced to resort to characterizing the organization as a “cult” in order to dissuade citizens from contributing to companies associated with the LaRouche political movement.

None of LaRouche’s detractors are able to deny his record of successful economic forecasts, including the collapse of the Bretton Woods System on August 15, 1971, the October 1987 collapse of the Wall Street stock market (which LaRouche forecast in May of that year), and his July 25, 2007 forecast, captured in webcast format, of what later became the September 2008 “trillions-dollar bailout.” Some of the most stunning of LaRouche forecasts, though, were not, strictly speaking, economic. On Columbus Day, October 12, 1988, Lyndon LaRouche, speaking at Berlin’s Kempinski Hotel Bristol, said:

“By profession, I am an economist in the tradition of Gottfried Wilhelm Leibniz and Friedrich List in Germany and of Alexander Hamilton and Mathew and Henry Carey in the United States. My political principles are those of Leibniz, List, and Hamilton, and are also consistent with those of Friedrich Schiller and Wilhelm von Humboldt. Like the founders of my republic, I have an uncompromising belief in the principle of absolutely sovereign nation-states, and I am therefore opposed to all supranational authorities which might undermine the sovereignty of any nation. However, like Schiller, I believe that every person who aspires to become a beautiful soul, must be at the same time a true patriot of his own nation, and also a world citizen.

“For these reasons, during the past 15 years I have become a specialist in my country’s foreign affairs. As a result of this work, I have gained increasing, significant influence among some circles around my own government on the interrelated subjects of U.S. foreign policy and strategy. My role during 1982 and 1983 in working with the U.S. National Security Council to shape the adoption of the policy known as the Strategic Defense Initiative, or ‘SDI,’ is an example of this. Although the details are confidential, I can report to you that my views on the current strategic situation are more influential in the United States today that at any time during the past. Therefore, I can assure you that what I present to you now, on the subject of prospects for the reunification of Germany, is a proposal which will be studied most seriously among the relevant establishment circles inside the United States. Under the proper conditions, many today will agree, that the time has come for early steps toward the reunification of Germany, with the obvious prospect that Berlin might resume its role as the capital.”

Targeted for Destruction

Two days after his Kempinski Hotel speech, federal indictments were issued against Lyndon LaRouche and several associates. Later, LaRouche, in speaking at the National Press Club on the indictments, stated: “One could say of the indictment itself, that all those that perpetrate offenses against God, or humanity, or both, are sooner or later punished.” The indictments followed by two years an October 6, 1986 assassination attempt against LaRouche, about which LaRouche wrote in his 2004 pamphlet titled “ ‘Convict Him, or Kill Him!’ The Night They Came To Kill Me,” the following:

“On October 6, 1986, a virtual army of more than four hundred armed personnel descended upon the town of Leesburg, Virginia, for a raid on the offices of EIR and its associates, and also deployed for another, darker mission. The premises at which I was residing at that time were surrounded by an armed force, while aircraft, armored vehicles, and other personnel waited for the order to move in shooting. Fortunately, the killing did not happen, because someone with higher authority than the Justice Department Criminal Division head, William Weld, ordered the attack on me called off. The forces readied to move in on me, my wife, and a number of my associates, were pulled back in the morning.

“This was the second fully documented case of a U.S. Justice Department involvement in operations aimed at my personal elimination from politics.”

Though LaRouche and six others were found guilty in an Alexandria, Virginia court in December of 1988, and were imprisoned on January 27, 1989, the international and national outcry against those corrupt convictions continues to this very day. Former U.S. Attorney General Ramsey Clark characterized the LaRouche case as “involving a broader range of deliberate cunning and systemic misconduct over a longer period of time using the power of the federal government resources than any other prosecution by the U.S. government in my time or to my knowledge.” Executive Intelligence Review’s September 2017 dossier, “Robert Mueller Is an Amoral Legal Assassin: He Will Do His Job If You Let Him” comprehensively reviews how the current special prosecutor against Donald Trump was a key component of the political persecution of Lyndon LaRouche in the 1980s.

During his time spent in prison, LaRouche continued to write, but by often dictating whole chapters of book manuscripts on phone calls, again without reference works of any kind. Apart from the collection titled The Science of Christian Economy and Other Prison Writings, LaRouche wrote or recorded many other documents, some of which have been compiled with other never-before-published writings.

During 1989, as it became clear that the Soviet Union’s Comecon sphere was experiencing increasing economic difficulties, LaRouche and his wife Helga cooperated intensely on a program called the “Productive Triangle Paris-Berlin-Vienna,” which after the disintegration of the Soviet Union was extended into the “Eurasian Land-Bridge.” After the elimination of the Iron Curtain, this program suggested the integration of the population and industrial centers of Europe with those of Asia through so-called development corridors. It was the only comprehensive peace plan for the 21st Century on the table at that time, an option which was fiercely countered by British and the Anglophile neo-cons in the United States, who instead pushed their policy of a unipolar world and neoliberal system. The Eurasian Land-Bridge, very early on, became known as “The New Silk Road.” Over two decades later, the Chinese Belt and Road Initiative, which grew out of this concept, has become the primary locomotive of world physical economy.

Changing Thousands of Lives

Upon his release from prison on January 26, 1994, LaRouche continued his career as a forecaster. He developed his “Triple Curve” pedagogy in 1995 to illustrate to non-economists how the process of “Weimar Germany-like hyperinflation” had gripped the trans-Atlantic world, and had so looted it that nothing could be done to preserve the dominant money system; It would have to be reorganized from the top down, utilizing Franklin Roosevelt’s New Deal-era Glass-Steagall Act to begin the process of bank reorganization. He warned in January 2001 of the danger of a violent terrorist attack on one or more American cities, placing this warning within the context of reviewing why and how the financial system had entered a phase of a “high-tech bubble” during 1999–2000.

LaRouche spoke of a “Reichstag Fire” possibility in light of the emerging ungovernability of the United States, under conditions of deepening economic ruin. And, as with his May 1987 forecast of a collapse of the stock market in October of 1987, on July 25, 2007 LaRouche stated, one year before the Lehman Brothers/AIG meltdown of September 2008:

“The world monetary financial system is actually now currently in the process of disintegrating. There is nothing mysterious about this; I’ve talked about it for some time, it’s been in progress, it’s not abating. What’s listed as stock values and market values in the financial markets internationally is bunk! They are purely fictitious beliefs. There is no truth to it; the fakery is enormous. There is no possibility of a non-collapse of the present financial system—none! It’s finished, now!

“The present financial system cannot continue to exist under any circumstances, under any Presidency, under any leadership, or any leadership of nations. Only a fundamental and sudden change in the world monetary financial system will prevent a general, immediate chain-reaction type of collapse. At what speed we don’t know, but it will go on, and it will be unstoppable. And the longer it goes on before coming to an end, the worse things will get.”

LaRouche, as evidenced from the above forecast, produced at 84 years of age, not only continued to be uniquely productive. At the turn of the millennium, LaRouche spearheaded a movement to recruit youth—a movement which became so successful that the Democratic Party in various parts of the country even attempted to co-opt it. Thousands of youth went through this educational process. Groundbreaking contributions in the presentation of the work of physicist Johannes Kepler, in the practice of bel canto Classical singing both for general secondary school education and as an antidote to cultural self-degradation, and the presentation of American history, including American current history (rather than “current events” or the even more degrading term, “news”), in video format such as the program 1932, were produced by the LaRouche Youth Movement.

From the time of his emergence as a public figure over fifty years ago, the only tragedy that characterized Lyndon LaRouche’s life, is that he was never permitted to carry out, either as President or as an adviser to the serving President, the economic reforms that would have improved the lives of tens of millions of Americans and hundreds of millions around the world.

Although Lyndon LaRouche has many friends who were leaders in the fields of science, music, economy, and politics, his greatest friend, apart from his wife, Helga, were the forgotten men and women of America and other countries.

Public Banking Made Simple – New Video

Short Video Explanation

Close Loss For L.A. Public Bank

Ellen Brown

Ellen Brown on the public banking measure: Hi, I’ve gotten inquiries on the outcome of the Los Angeles ballot measure to approve a city-owned bank , so thought I would send a quick update. Unfortunately it did not pass, but it did get 42 percent of the vote. It was a remarkable outcome considering that the dynamic young Public Bank LA advocacy group effectively only had a month to educate 4 million voters on what a public bank is and why passing the measure was a good idea. If they had had another month, the bill could well have passed.

The City Council took supporters by surprise when it put the charter amendment on the ballot in July, leaving only four months to promote it. Passing a ballot measure typically takes a campaign war chest of $750,000 or more, and the all-volunteer PBLA group began with no funding and no formal group. The first challenge was clearing the legal requirement of forming a campaign committee, which itself takes funding and some expertise. The committee only began amassing campaign funds a month before the November 6 vote, after which it managed to bring in $60,000.

Most of the campaign, however, was conducted with sheer people power. According to PBLA political director Ben Hauck, in that short time the all-volunteer team managed to gain endorsements from over 100 organizations and community leaders, text message 350,000 voters, hand out over 50,000 flyers, reach over 500,000 voters through social media campaigns, get included in three mailers reaching over 1,200,000 voters, put up hundreds of yard signs and banners across L.A., talk with thousands of voters at events, universities, rallies and gatherings across the city, get featured in dozens of major news stories, articles and TV coverage, manage their own paid social media campaign, drive over 150,000 video views on a YouTube campaign, contact 200,000 voters via a robocall from the Chairman of the California Democratic Party, put on several significant campaign events, get featured in a press event with senatorial candidate Kevin de León and City Council President Herb Wesson, and create several featured videos, dozens of ads, and countless pieces of written content.

The PBLA team is pressing on undaunted. Leader Trinity Tran wrote after the vote, “Over a quarter million Angelenos voted in support of Measure B and the conversation on public banking has now been amplified across the country. This is just the beginning of the national movement. And it’s a fight we are certain will be won.”

We’re hugely proud of the PBLA team! Their dramatic achievements in a very short time are a testament to the power of a committed group of volunteers working together at the local level for a cause they feel strongly about.

If you would like to follow the progress of the public banking movement across the country, please sign up for the Public Banking Institute newsletter, linked here.

Best wishes,

Ellen

http://EllenBrown.com

http://PublicBankingInstitute.org

How Los Angeles Can Have It’s Own Bank & Free Itself From Wall Street

The Movement to Public Banking

by Ellen Brown

Photo by Paul Hunt

Wall Street Owns The Country

(From Ellen Brown’s article on TruthDig.com) Wall Street owns the country. That was the opening line of a fiery speech that populist leader Mary Ellen Lease delivered around 1890. Franklin Roosevelt said it again in a letter to Colonel House in 1933, and Sen. Dick Durbin was still saying it in 2009. “The banks—hard to believe in a time when we’re facing a banking crisis that many of the banks created—are still the most powerful lobby on Capitol Hill,” Durbin said in an interview. “And they frankly own the place.”

Wall Street banks triggered a credit crisis in 2008-09 that wiped out over $19 trillion in household wealth, turned some 10 million families out of their homes and cost almost 9 million jobs in the U.S. alone. Yet the banks were bailed out without penalty, while defrauded home buyers were left without recourse or compensation. The banks made a killing on interest rate swaps with cities and states across the country, after a compliant and accommodating Federal Reserve dropped interest rates nearly to zero. Attempts to renegotiate these deals have failed.

In Los Angeles, the City Council was forced to reduce the city’s budget by 19 percent following the banking crisis, slashing essential services, while Wall Street has not budged on the $4.9 million it claims annually from the city on its swaps. Wall Street banks are now collecting more from Los Angeles just in fees than it has available to fix its ailing roads.

Local governments have been in bondage to Wall Street ever since the 19th century despite multiple efforts to rein them in. Regulation has not worked. To break free, we need to divest our public funds from these banks and move them into our own publicly owned banks.

L.A. Takes It to the Voters

Some cities and states have already moved forward with feasibility studies and business plans for forming their own banks. But the city of Los Angeles faces a barrier to entry that other cities don’t have. In 1913, the same year the Federal Reserve was formed to backstop the private banking industry, the city amended its charter to state that it had all the powers of a municipal corporation, “with the provision added that the city shall not engage in any purely commercial or industrial enterprise not now engaged in, except on the approval of the majority of electors voting thereon at an election.”

Under this provision, voter approval would apparently not be necessary for a city owned bank that limited itself to taking the city’s deposits and refinancing municipal bonds as they came due, since that sort of bank would not be a “purely commercial or industrial enterprise” but would simply be a public utility that made more efficient use of public funds. But voter approval would evidently be required to allow the city to explore how public banks can benefit local economic development, rather than just finance public projects.

The L.A. City Council could have relied on this 1913 charter amendment to say “no” to the dynamic local movement led by millennial activists to divest from Wall Street and create a city owned bank. But the City Council chose instead to jump that hurdle by putting the matter to the voters. In July 2018, it added Charter Amendment B to the November ballot. A “yes” vote will allow the creation of a city owned bank that can partner with local banks to provide low-cost credit for the community, following the stellar precedent of the century old Bank of North Dakota, currently the nation’s only state-owned bank. By cutting out Wall Street middlemen, the Bank of North Dakota has been able to make below-market credit available to local businesses, farmers and students while still being more profitable than some of Wall Street’s largest banks. Following that model would have a substantial upside for both the small business and the local banking communities in Los Angeles.

Rebutting the Opposition

On Sept. 20, the Los Angeles Times editorial board threw cold water on this effort, calling the amendment “half-baked” and “ill-conceived,” and recommending a “no” vote.

Yet not only was the measure well-conceived, but L.A. City Council President Herb Wesson has shown visionary leadership in recognizing its revolutionary potential. He sees the need to declare our independence from Wall Street. He has said that the country looks to California to lead, and that Los Angeles needs to lead California. The people deserve it, and the millennials whose future is in the balance have demanded it.

The City Council recognizes that it’s going to be an uphill battle. Charter Amendment B just asks voters, “Do you want us to proceed?” It is merely an invitation to begin a dialogue on creating a new kind of bank—one geared to serving the people rather than Wall Street.

Amendment B does not give the City Council a blank check to create whatever bank it likes. It just jumps the first of many legal hurdles to obtaining a bank charter. The California Department of Business Oversight (DBO) will have the last word, and it grants bank charters only to applicants that are properly capitalized, collateralized and protected against risk. Public banking experts have talked to the DBO at length and understand these requirements; and a detailed summary of a model business plan has been prepared, to be posted shortly.

The L.A. Times editorial board erroneously compares the new effort with the failed Los Angeles Community Development Bank, which was founded in 1992 and was insolvent a decade later. That institution was not a true bank and did not have to meet the DBO’s stringent requirements for a bank charter. It was an unregulated, non-depository, nonprofit loan and equity fund, capitalized with funds that were basically a handout from the federal government to pacify the restless inner city after riots broke out in 1992—and its creation was actually supported by the L.A. Times.

The Times also erroneously cites a 2011 report by the Boston Federal Reserve contending that a Massachusetts state-owned bank would require $3.6 billion in capitalization. That prohibitive sum is regularly cited by critics bent on shutting down the debate without looking at the very questionable way in which it was derived. The Boston authors began with the $2 million used in 1919 to capitalize the Bank of North Dakota, multiplied that number up for inflation, multiplied it up again for the increase in GDP over a century and multiplied it up again for the larger population of Massachusetts. This dubious triple-counting is cited as serious research, although economic growth and population size have nothing to do with how capital requirements are determined.

Bank capital is simply the money that is invested in a bank to leverage loans. The capital needed is based on the size of the loan portfolio. At a 10 percent capital requirement, $100 million is sufficient to capitalize $1 billion in loans, which would be plenty for a startup bank designed to prove the model. That sum is already more than three times the loan portfolio of the California Infrastructure and Development Bank, which makes below-market loans on behalf of the state. As profits increase the bank’s capital, more loans can be added. Bank capitalization is not an expenditure but an investment, which can come from existing pools of unused funds or from a bond issue to be repaid from the bank’s own profits.

Deposits will be needed to balance a $1 billion loan portfolio, but Los Angeles easily has them—they are now sitting in Wall Street banks having no fiduciary obligation to reinvest them in Los Angeles. The city’s latest Comprehensive Annual Financial Report shows a Government Net Position of over $8 billion in Cash and Investments (liquid assets), plus proprietary, fiduciary and other liquid funds. According to a 2014 study published by the Fix LA Coalition:

Together, the City of Los Angeles, its airport, seaport, utilities and pension funds control $106 billion that flows through financial institutions in the form of assets, payments and debt issuance. Wall Street profits from each of these flows of money not only through the multiple fees it charges, but also by lending or leveraging the city’s deposited funds and by structuring deals in unnecessarily complex ways that generate significant commissions.

Despite having slashed spending in the wake of revenue losses from the Wall Street-engineered financial crisis, Los Angeles is still being crushed by Wall Street financial fees, to the tune of nearly $300 million—just in 2014. The savings in fees alone from cutting out Wall Street middlemen could thus be considerable, and substantially more could be saved in interest payments. These savings could then be applied to other city needs, including for affordable housing, transportation, schools and other infrastructure.

In 2017, Los Angeles paid $1.1 billion in interest to bondholders, constituting the wealthiest 5 percent of the population. Refinancing that debt at just 1 percent below its current rate could save up to 25 percent on the cost of infrastructure, half the cost of which is typically financing. Consider, for example, Proposition 68, a water bond passed by California voters last summer. Although it was billed as a $4 billion bond, the total outlay over 40 years at 4 percent will actually be $8 billion. Refinancing the bond at 3 percent (the below-market rate charged by the California Infrastructure and Development Bank) would save taxpayers nearly $2 billion on the overall cost of the bond.

Finding the Political Will

The numbers are there to support the case for a city owned bank, but a critical ingredient in effecting revolutionary change is finding the political will. Being first in any innovation is always the hardest. Reasons can easily be found for saying “no.” What is visionary and revolutionary is to say, “Yes, we can do this.”

As California goes, so goes the nation, and legislators around the country are watching to see how it goes in Los Angeles. Rather than criticism, Council President Wesson deserves high praise for stepping forth in the face of predictable pushback and daunting legal hurdles to lead the country in breaking free from our centuries-old subjugation to Wall Street exploitation.

Hear Ellen Brown in Santa Monica

DATE: Thursday October 4, 2018

LOCATION: The Satellite Flexible Workspace 3110 Main St., Annex Building C 2nd Floor Santa Monica, CA 90405

TIME: 7:30 PANEL BEGINS!

6:30-7:30 Please arrive EARLY for NETWORKING and snacks

Followed by Q & A with the members of our Public Bank LA panel & more snacks and networking! (we will wrap it up by 9:30/10)

COST: $10 (donation for location and snacks)

Why Interest Rates Are Rising

FED Agressively Raising Rates

By Ellen Brown

The Fed is aggressively raising interest rates, although inflation is contained, private debt is already at 150% of GDP, and rising variable rates could push borrowers into insolvency. So what is driving the Fed’s push to “tighten”?

Ellen Brown

On March 31st the Federal Reserve raised its benchmark interest rate for the sixth time in 3 years and signaled its intention to raise rates twice more in 2018, aiming for a fed funds target of 3.5% by 2020. LIBOR (the London Interbank Offered Rate) has risen even faster than the fed funds rate, up to 2.3% from just 0.3% 2-1/2 years ago. LIBOR is set in London by private agreement of the biggest banks, and the interest on $3.5 trillion globally is linked to it, including $1.2 trillion in consumer mortgages.

Alarmed commentators warn that global debt levels have reached $233 trillion, more than three times global GDP; and that much of that debt is at variable rates pegged either to the Fed’s interbank lending rate or to LIBOR. Raising rates further could push governments, businesses and homeowners over the edge. In its Global Financial Stability report in April 2017, the International Monetary Fund warned that projected interest rises could throw 22% of US corporations into default.

Then there is the US federal debt, which has more than doubled since the 2008 financial crisis, shooting up from $9.4 trillion in mid-2008 to over $21 trillion in April 2018. Adding to that debt burden, the Fed has announced that it will be dumping its government bonds acquired through quantitative easing at the rate of $600 billion annually. It will sell $2.7 trillion in federal securities at the rate of $50 billion monthly beginning in October. Along with a government budget deficit of $1.2 trillion, that’s nearly $2 trillion in new government debt that will need financing annually.

If the Fed follows through with its plans, projections are that by 2027, US taxpayers will owe $1 trillion annually just in interest on the federal debt. That is enough to fund President Trump’s original trillion dollar infrastructure plan every year. And it is a direct transfer of wealth from the middle class to the wealthy investors holding most of the bonds. Where will this money come from? Even crippling taxes, wholesale privatization of public assets, and elimination of social services will not cover the bill.

With so much at stake, why is the Fed increasing interest rates and adding to government debt levels? Its proffered justifications don’t pass the smell test.

“Faith-Based” Monetary Policy

In setting interest rates, the Fed relies on a policy tool called the “Phillips curve,” which allegedly shows that as the economy nears full employment, prices rise. The presumption is that workers with good job prospects will demand higher wages, driving prices up. But the Phillips curve has proven virtually useless in predicting inflation, according to the Fed’s own data. Former Fed Chairman Janet Yellen has admitted that the data fails to support the thesis, and so has Fed Governor Lael Brainard. Minneapolis Fed President Neel Kashkari calls the continued reliance on the Phillips curve “faith-based” monetary policy. But the Federal Open Market Committee (FOMC), which sets monetary policy, is undeterred.

“Full employment” is considered to be 4.7% unemployment. When unemployment drops below that, alarm bells sound and the Fed marches into action. The official unemployment figure ignores the great mass of discouraged unemployed who are no longer looking for work, and it includes people working part-time or well below capacity. But the Fed follows models and numbers, and as of April 2018, the official unemployment rate had dropped to 4.3%. Based on its Phillips curve projections, the FOMC is therefore taking steps to aggressively tighten the money supply.

The notion that shrinking the money supply will prevent inflation is based on another controversial model, the monetarist dictum that “inflation is always and everywhere a monetary phenomenon”: inflation is always caused by “too much money chasing too few goods.” That can happen, and it is called “demand-pull” inflation. But much more common historically is “cost-push” inflation: prices go up because producers’ costs go up. And a major producer cost is the cost of borrowing money. Merchants and manufacturers must borrow in order to pay wages before their products are sold, to build factories, buy equipment and expand. Rather than lowering price inflation, the predictable result of increased interest rates will be to drive consumer prices up, slowing markets and increasing unemployment – another Great Recession. Increasing interest rates is supposed to cool an “overheated” economy by slowing loan growth, but lending is not growing today. Economist Steve Keen has shown that at about 150% private debt to GDP, countries and their populations do not take on more debt. Rather, they pay down their debts, contracting the money supply; and that is where we are now.

The Fed’s reliance on the Phillips curve does not withstand scrutiny. But rather than abandoning the model, the Fed cites “transitory factors” to explain away inconsistencies in the data. In a December 2017 article in The Hill, Tate Lacey observed that the Fed has been using this excuse ever since 2012, citing one “transitory factor” after another, from temporary movements in oil prices, to declining import prices and dollar strength, to falling energy prices, to changes in wireless plans and prescription drugs. The excuse is wearing thin.

The Fed also claims that the effects of its monetary policies lag behind the reported data, making the current rate hikes necessary to prevent problems in the future. But as Lacey observes, GDP is not a lagging indicator, and it shows that the Fed’s policy is failing. Over the last two years, leading up to and continuing through the Fed’s tightening cycle, nominal GDP growth averaged just over 3%; while in the two prior years, nominal GDP grew at more than 4%. Thus “the most reliable indicator of the stance of monetary policy, nominal GDP, is already showing the contractionary impact of the Fed’s policy decisions,” says Lacey, “signaling that its plan will result in further monetary tightening, or worse, even recession.”

Follow the Money

If the Phillips curve, the inflation rate and loan growth don’t explain the push for higher interest rates, what does? The answer was suggested in an April 12th Bloomberg article by Yalman Onaran, titled “Surging LIBOR, Once a Red Flag, Is Now a Cash Machine for Banks.” He wrote:

The largest U.S. lenders could each make at least $1 billion in additional pretax profit in 2018 from a jump in the London interbank offered rate for dollars, based on data disclosed by the companies. That’s because customers who take out loans are forced to pay more as Libor rises while the banks’ own cost of credit has mostly held steady.

During the 2008 crisis, high LIBOR rates meant capital markets were frozen, since the banks’ borrowing rates were too high for them to turn a profit. But US banks are not dependent on the short-term overseas markets the way they were a decade ago. They are funding much of their operations through deposits, and the average rate paid by the largest US banks on their deposits climbed only about 0.1% last year, despite a 0.75% rise in the fed funds rate. Most banks don’t reveal how much of their lending is at variable rates or is indexed to LIBOR, but Oneran comments:

JPMorgan Chase & Co., the biggest U.S. bank, said in its 2017 annual report that $122 billion of wholesale loans were at variable rates. Assuming those were all indexed to Libor, the 1.19 percentage-point increase in the rate in the past year would mean $1.45 billion in additional income.

Raising the fed funds rate can be the same sort of cash cow for US banks. According to a December 2016 Wall Street Journal article titled “Banks’ Interest-Rate Dreams Coming True”:

While struggling with ultralow interest rates, major banks have also been publishing regular updates on how well they would do if interest rates suddenly surged upward. . . . Bank of America . . . says a 1-percentage-point rise in short-term rates would add $3.29 billion. . . . [A] back-of-the-envelope calculation suggests an incremental $2.9 billion of extra pretax income in 2017, or 11.5% of the bank’s expected 2016 pretax profit . . . .

As observed in an April 12 article on Seeking Alpha:

About half of mortgages are . . . adjusting rate mortgages [ARMs] with trigger points that allow for automatic rate increases, often at much more than the official rate rise. . . .

One can see why the financial sector is keen for rate rises as they have mined the economy with exploding rate loans and need the consumer to get caught in the minefield.

Even a modest rise in interest rates will send large flows of money to the banking sector. This will be cost-push inflationary as finance is a part of almost everything we do, and the cost of business and living will rise because of it for no gain.

Cost-push inflation will drive up the Consumer Price Index, ostensibly justifying further increases in the interest rate, in a self-fulfilling prophecy in which the FOMC will say, “We tried – we just couldn’t keep up with the CPI.”

A Closer Look at the FOMC

The FOMC is composed of the Federal Reserve’s seven-member Board of Governors, the president of the New York Fed, and four presidents from the other 11 Federal Reserve Banks on a rotating basis. All 12 Federal Reserve Banks are corporations, the stock of which is 100% owned by the banks in their districts; and New York is the district of Wall Street. The Board of Governors currently has four vacancies, leaving the member banks in majority control of the FOMC. Wall Street calls the shots; and Wall Street stands to make a bundle off rising interest rates.

The Federal Reserve calls itself “independent,” but it is independent only of government. It marches to the drums of the banks that are its private owners. To prevent another Great Recession or Great Depression, Congress needs to amend the Federal Reserve Act, nationalize the Fed, and turn it into a public utility, one that is responsive to the needs of the public and the economy.

Ellen Brown’s latest

Book

Goldman Bankers Flood Trump Administration

Heavy Bankers Influence on Both Parties Now Visible

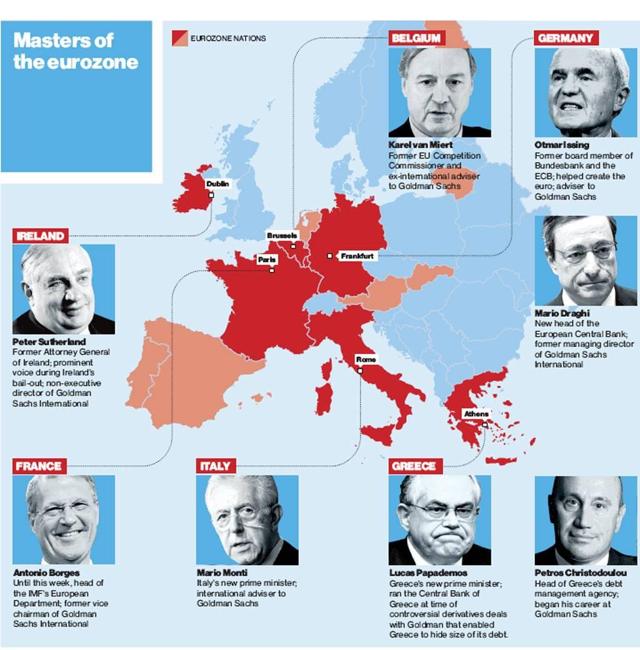

The Hidden Hand of Bankers Rule both the U.S. and the E.U.

President Donald Trump plans on adding another Goldman Sachs veteran to his administration, saying Tuesday that he will nominate James Donavan, the acting managing director of Goldman, as his deputy treasury secretary.

Donavan would become the third major Goldman veteran to join the administration straight out of Wall Street. Former Goldman Chief Operating Officer Gary Cohn, who is now the director of the White House National Economic Council, and Dina Powell, who is now the White House’s senior counselor for economic initiatives, were on Goldman payroll when they accepted rolls in the Trump White House. Other Goldman alums include Treasury Secretary Steven Mnuchin and White House chief strategist Stephen Bannon.

Goldman Bankers Wide Influence in E.U.

French President Another Banker

A Tale of Two Countries on a Business Card

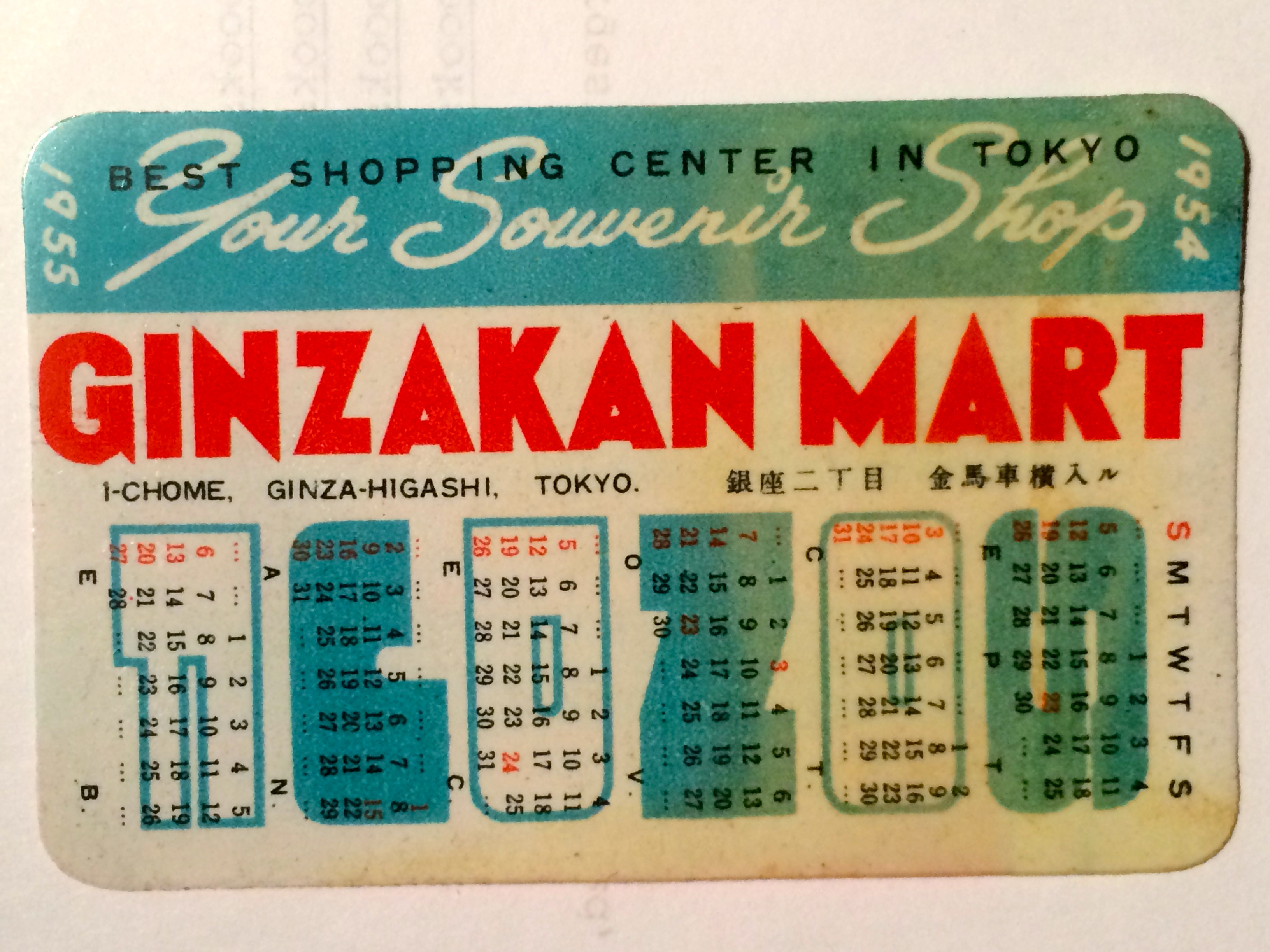

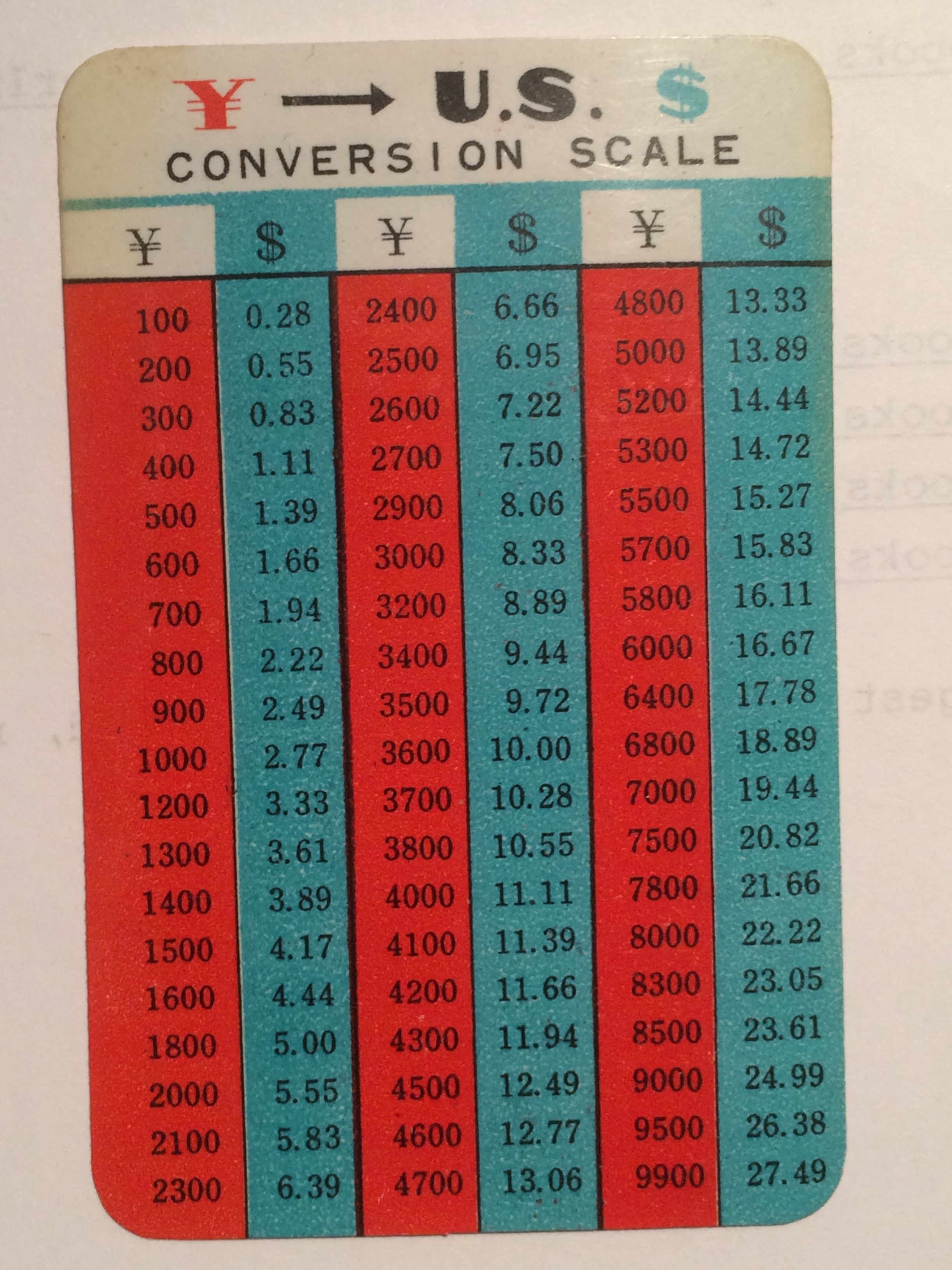

Since 1955 The U.S. Dollar Has Dropped About 66% Against the Japanese Yen – Yet U.S. Politicians Claim No Inflation

This card was given out to American Tourists in 1955. The reverse side of the card has the official yen – dollar exchange rate.

Notice 400 yen is about $1.11. Today, the exchange rate to get $1.11 would be only 133 yen! Don’t believe Washington’s hype about “The Strong Dollar.” The U.S. is the worst debtor nation in history, printing fiat money to prop up the insolvent Banks.

The Confiscation of Bank Deposits

Ellen Brown Interviewed by James Corbett