Category Archives: Big Banks

Report Ukrainian Gold Transferred to U.S.

Secret Transfer of Ukrainian Gold Reserves Is First Step to International Bankers Control of Ukraine

The gold reserves of the Ukraine were secretly transferred to the United States, according to information from GATA, the Gold Anti-Trust Action Committee. Citing sources in the Ukraine, it is apparent that the IMF has organized the looting of the gold reserves for “safe-keeping”, just in case the Russians invade. The European Troika has worked with western banks to loot the gold reserves of other countries, the last one being the seizing of the Cyprus gold reserves during the bankster caused collapse of the Cypriot economy and the looting of the bank deposits held by churches, businesses, pensioners, and other ordinary folk.

The report from Ukrainian news sources reads as follows:

From Iskra News, Zaporozhye, Ukraine

Friday, March 7, 2014

http://iskra-news.info/news/segodnja_nochju_iz_borispolja_v_ssha_strarto…

At 2 a.m. this morning an unmarked transport plane was on the runway at Borispol Airport. According to airport staff, before the plane came to the airport, four trucks and two Volkswagen minibuses arrived, all the truck license plates missing.

Fifteen people in black uniforms, masks, and body armor stepped out, some armed with machine guns. They loaded the plane with more than 40 heavy boxes.

After that a mysterious men arrived and entered the plane.

All loading was done in a hurry.

The plane took off on an emergency basis.

Those who saw this mysterious special operation immediately notified the airport officials, who told the callers not to meddle in other people’s affairs.

Later a returned call from a senior official of the former Ministry of Income and Fees reported that tonight, on the orders of one of the new leaders of Ukraine, the United States had taken custody of all the gold reserves in Ukraine.

The bad news for the people of the Ukraine is that their chances of ever seeing this gold again is slim indeed. Many other countries have asked for their gold back from the U.S Federal Reserve recently, including Germany. There is a world-wide struggle for gold at the present time, a secret war pitting China against the U.S.- Euro block. The bankers know full well that their fiat money system could collapse at any time, and are in a furious struggle to stockpile gold for future operations.

Western Looting of Ukraine Has Begun

Western Looting Of Ukraine Has Begun

Paul Craig Roberts

It is now apparent that the “Maiden protests” in Kiev were in actuality a Washington organized coup against the elected democratic government. The purpose of the coup is to put NATO military bases on Ukraine’s border with Russia and to impose an IMF austerity program that serves as cover for Western financial interests to loot the country. The sincere idealistic protesters who took to the streets without being paid were the gullible dupes of the plot to destroy their country.

It is now apparent that the “Maiden protests” in Kiev were in actuality a Washington organized coup against the elected democratic government. The purpose of the coup is to put NATO military bases on Ukraine’s border with Russia and to impose an IMF austerity program that serves as cover for Western financial interests to loot the country. The sincere idealistic protesters who took to the streets without being paid were the gullible dupes of the plot to destroy their country.

Politically Ukraine is an untenable aggregation of Ukrainian and Russian territory, because traditional Russian territories were stuck into the borders of the Ukraine Soviet Republic by Lenin and Khrushchev. The Crimea, stuck into Ukraine by Khrushchev, has already departed and rejoined Russia. Unless some autonomy is granted to them, Russian areas in eastern and southern Ukraine might also depart and return to Russia. If the animosity displayed toward the Russian speaking population by the stooge government in Kiev continues, more defections to Russia are likely.

The Washington-imposed coup faces other possible difficulties from what seems to be a growing conflict between the well-organized Right Sector and the Washington-imposed stooges. If armed conflict between these two groups were to occur, Washington might conclude that it needs to send help to its stooges. The appearance of US/NATO troops in Ukraine would create pressure on Putin to occupy the remaining Russian speaking parts of Ukraine.

Before the political and geographical issues are settled, the Western looting of Ukraine has already begun. The Western media, doesn’t tell any more truth about IMF “rescue packages” than it does about anything else. The media reports, and many Ukrainians believe, that the IMF is going to rescue Ukraine financially by giving the country billions of dollars.

Before the political and geographical issues are settled, the Western looting of Ukraine has already begun. The Western media, doesn’t tell any more truth about IMF “rescue packages” than it does about anything else. The media reports, and many Ukrainians believe, that the IMF is going to rescue Ukraine financially by giving the country billions of dollars.

Ukraine will never see one dollar of the IMF money. What the IMF is going to do is to substitute Ukrainian indebtedness to the IMF for Ukrainian indebtedness to Western banks. The IMF will hand over the money to the Western banks, and the Western banks will reduce Ukraine’s indebtedness by the amount of IMF money. Instead of being indebted to the banks, Ukraine will now be indebted to the IMF.

Now the looting can begin. The IMF loan brings new conditions and imposes austerity on the Ukrainian people so that the Ukraine government can gather up the money with which to repay the IMF. The IMF conditions that will be imposed on the struggling Ukraine population will consist of severe reductions in old-age pensions, in government services, in government employment, and in subsidies for basic consumer purchases such as natural gas. Already low living standards will plummet. In addition, Ukrainian public assets and Ukrainian owned private industries will have to be sold off to Western purchasers.

Additionally, Ukraine will have to float its currency. In a futile effort to protect its currency’s value from being driven very low (and consequently import prices very high) by speculators ganging up on the currency and short-selling it, Ukraine will borrow more money with which to support its currency in the foreign exchange market. Of course, the currency speculators will end up with the borrowed money, leaving Ukraine much deeper in debt than currently.

Additionally, Ukraine will have to float its currency. In a futile effort to protect its currency’s value from being driven very low (and consequently import prices very high) by speculators ganging up on the currency and short-selling it, Ukraine will borrow more money with which to support its currency in the foreign exchange market. Of course, the currency speculators will end up with the borrowed money, leaving Ukraine much deeper in debt than currently.

The corruption involved is legendary, so the direct result of the gullible Maiden protesters will be lower Ukrainian living standards, more corruption, loss of sovereignty over the country’s economic policy, and the transfer of Ukrainian public and private property to Western interests.

If Ukraine also falls into NATO’s clutches, Ukraine will also find itself in a military alliance against Russia and find itself targeted by Russian missiles. This will be a tragedy for Ukraine and Russia as Ukrainians have relatives in Russia and Russians have relatives in Ukraine. The two countries have essentially been one for 200 years. To have them torn apart by Western looting and Washington’s drive for world hegemony is a terrible shame and a great crime.

The gullible dupes who participated in the orchestrated Maiden protests will rue it for the rest of their lives.

When the protests began, I described what the consequences would be and said that I would explain the looting process. It is not necessary for me to do so. Professor Michel Chossudovsky has explained the IMF looting process along with much history here:

One final word. Despite unequivocal evidence of one country after another being looted by the West, governments of indebted countries continue to sign up for IMF programs. Why do governments of countries continue to agree to the foreign looting of their populations? The only answer is that they are paid. The corruption that is descending upon Ukraine will make the former regime look honest.

Click here to go to Paul Craig Roberts website.

Fraud Ridden Banks Not California’s Only Option

Fraud “Epic In Scale”…

Ellen Brown

Just in from www.GlobalResearch.com

“Epic in scale, unprecedented in world history.” That is how William K. Black, professor of law and economics and former bank fraud investigator, describes the frauds in which JPMorgan Chase (JPM) has now been implicated. They involve more than a dozen felonies, including bid-rigging on municipal bond debt; colluding to rig interest rates on hundreds of trillions of dollars in mortgages, derivatives and other contracts; exposing investors to excessive risk; failing to disclose known risks, including those in the Bernie Madoff scandal; and engaging in multiple forms of mortgage fraud.

So why, asks Chicago Alderwoman Leslie Hairston, are we still doing business with them? She plans to introduce a city council ordinance deleting JPM from the city’s list of designated municipal depositories. As quoted in the January 14th Chicago Sun-Times:

The bank has violated the city code by making admissions of dishonesty and deceit in the way they dealt with their investors in the mortgage securities and Bernie Madoff Ponzi scandals. . . . We use this code against city contractors and all the small companies, why wouldn’t we use this against one of the largest banks in the world?

A similar move has been recommended for the City of Los Angeles by L.A. City Councilman Gil Cedillo. But in a January 19th editorial titled “There’s No Profit in L A. Bashing JPMorgan Chase,” the L.A. Times editorial board warned against pulling the city’s money out of JPM and other mega-banks – even though the city attorney is suing them for allegedly causing an epidemic of foreclosures in minority neighborhoods.

“L.A. relies on these banks,” says The Times, “for long-term financing to build bridges and restore lakes, and for short-term financing to pay the bills.” The editorial noted that a similar proposal brought in the fall of 2011 by then-Councilman Richard Alarcon, backed by Occupy L.A., was abandoned because it would have resulted in termination fees and higher interest payments by the city.

It seems we must bow to our oppressors because we have no viable alternative – or do we? What if there is an alternative that would not only save the city money but would be a safer place to deposit its funds than in Wall Street banks?

The Tiny State That Broke Free

There is a place where they don’t bow. Where they don’t park their assets on Wall Street and play the mega-bank game, and haven’t for almost 100 years. Where they escaped the 2008 banking crisis and have no government debt, the lowest foreclosure rate in the country, the lowest default rate on credit card debt, and the lowest unemployment rate. They also have the only publicly-owned bank.

The place is North Dakota, and their state-owned Bank of North Dakota (BND) is a model for Los Angeles and other cities, counties, and states.

Like the BND, a public bank of the City of Los Angeles would not be a commercial bank and would not compete with commercial banks. In fact, it would partner with them – using its tax revenue deposits to create credit for lending programs through the magical everyday banking practice of leveraging capital.

The BND is a major money-maker for North Dakota, returning about $30 million annually in dividends to the treasury – not bad for a state with a population that is less than one-fifth that of the City of Los Angeles. Every year since the 2008 banking crisis, the BND has reported a return on investment of 17-26%.

Like the BND, a Bank of the City of Los Angeles would provide credit for city projects – to build bridges, restore lakes, and pay bills – and this credit would essentially be interest-free, since the city would own the bank and get the interest back. Eliminating interest has been shown to reduce the cost of public projects by 35% or more.

Awesome Possibilities for Los Angeles

Consider what that could mean for Los Angeles. According to the current fiscal budget, the LAX Modernization project is budgeted at $4.11 billion. That’s the sticker price. But what will it cost when you add interest on revenue bonds and other funding sources? The San Francisco-Oakland Bay Bridge earthquake retrofit boondoggle was slated to cost about $6 billion. Interest and bank fees added another $6 billion. Funding through a public bank could have saved taxpayers $6 billion, or 50%.

If Los Angeles owned its own bank, it could also avoid costly “rainy day funds,” which are held by various agencies as surplus taxes. If the city had a low-cost credit line with its own bank, these funds could be released into the general fund, generating massive amounts of new revenue for the city.

The potential for the City and County of Los Angeles can be seen by examining their respective Comprehensive Annual Financial Reports (CAFRs). According to the latest CAFRs (2012), the City of Los Angeles has “cash, pooled and other investments” of $11 billion beyond what is in its pension fund (page 85), and the County of Los Angeles has $22 billion (page 66). To put these sums in perspective, the austerity crisis declared by the State of California in 2012 was the result of a declared state budget deficit of only $16 billion.

The L.A. CAFR funds are currently drawing only minimal interest. With some modest changes in regulations, they could be returned to the general fund for use in the city’s budget, or deposited or invested in the city’s own bank, to be leveraged into credit for local purposes.

Minimizing Risk

Beyond being a money-maker, a city-owned bank can minimize the risks of interest rate manipulation, excessive fees, and dishonest dealings.

Another risk that must now be added to the list is that of confiscation in the event of a “bail in.” Public funds are secured with collateral, but they take a back seat in bankruptcy to the “super priority” of Wall Street’s own derivative claims. A major derivatives fiasco of the sort seen in 2008 could wipe out even a mega-bank’s available collateral, leaving the city with empty coffers.

The city itself could be propelled into bankruptcy by speculative derivatives dealings with Wall Street banks. The dire results can be seen in Detroit, where the emergency manager, operating on behalf of the city’s creditors, put it into bankruptcy to force payment on its debts. First in line were UBS and Bank of America, claiming speculative winnings on their interest-rate swaps, which the emergency manager paid immediately before filing for bankruptcy. Critics say the swaps were improperly entered into and were what propelled the city into bankruptcy. Their propriety is now being investigated by the bankruptcy judge.

Not Too Big to Abandon

Mega-banks might be too big to fail. According to U.S. Attorney General Eric Holder, they might even be too big to prosecute. But they are not too big to abandon as depositories for government funds.

There may indeed be no profit in bashing JPMorgan Chase, but there would be profit in pulling deposits out and putting them in Los Angeles’ own public bank. Other major cities currently exploring that possibility include San Franciscoand Philadelphia.

If North Dakota can bypass Wall Street with its own bank and declare its financial independence, so can the City of Los Angeles. And so can the County. And so can the State of California.

Ellen Brown is an attorney, chairman of the Public Banking Institute, and author of 12 books including The Public Bank Solution. She is currently running for California state treasurer on the Green Party ticket.

– See more at: http://www.globalresearch.ca/enough-is-enough-fraud-ridden-banks-are-not-californias-only-option/5366715#sthash.jLqlWRYb.dpuf

Wreak Havoc, Rob a Bank, Get a Bonus

Class Warfare Unmasked

by Thomas Magstadt

From www.NationOfChange.org

Breaking news that stock markets around the world are in free-fall mode competing with a story about JP Morgan CEO Jamie Dimon being awarded a heart-stopping, headline-grabbing, tub-thumping pay increase for 2013. What does it mean?

Supposedly, Dimon was asking for his 2013 compensation to be roughly equal to his 2012 pay. But the bank’s board of directors awarded Dimon $20 million for 2013—that’s a tidy $8.5 million raise! Never mind that “JPMorgan Chase recently reached yet another settlement with the U.S. government—a $13 billion deal with the Department of Justice for peddling deceptive mortgages.” Never mind that the bank reported a $400 million loss in the 3rd quarter thanks to a $7.2 billion legal tab. Never mind that this fine, upstanding financial institution is holding $23 billion in reserves for potential litigation. And never mind that we’re talking about a too-big-to-fail bank whose top managers “recklessly gambled with our economy.”

JP Morgan is still flying high and Jamie Dimon got a 74 percent raise last week.

Click here to read the rest of the article.

How Economists and Policymakers Destroyed Our Economy

Secret Treaty Now Threatens Our Way of Life

Paul Craig Roberts

From www.paulcraigroberts.org

The economy has been debilitated by the offshoring of middle class jobs for the benefit of corporate profits and by the Federal Reserve’s policy of Quantitative Easing in order to support a few oversized banks that the government protects from market discipline. Not only does QE distort bond and stock markets, it threatens the value of the dollar and has resulted in manipulation of the gold price. See article – click here.

When US corporations send jobs offshore, the GDP, consumer income, tax base, and careers associated with the jobs go abroad with the jobs. Corporations gain the additional profits at large costs to the economy in terms of less employment, less economic growth, reduced state, local and federal tax revenues, wider deficits, and impairments of social services.

When policymakers permitted banks to become independent of market discipline, they made the banks an unresolved burden on the economy. Authorities have provided no honest report on the condition of the banks. It remains to be seen if the Federal Reserve can create enough money to monetize enough debt to rescue the banks without collapsing the US dollar. It would have been far cheaper to let the banks fail and be reorganized.

US policymakers and their echo chamber in the economics profession have let the country down badly. They claimed that there was a “New Economy” to take the place of the “old economy” jobs that were moved offshore. As I have pointed out for a decade, US jobs statistics show no sign of the promised “New Economy.”

The same policymakers and economists who told us that “markets are self-regulating” and that the financial sector could safely be deregulated also confused jobs offshoring with free trade. Hyped “studies” were put together designed to prove that jobs offshoring was good for the US economy. It is difficult to fathom how such destructive errors could consistently be made by policymakers and economists for more than a decade. Were these mistakes or cover for a narrow and selfish agenda?

In June, 2009 happy talk appeared about “the recovery,” now 4.5 years old. As John Williams (shadowstats.com) has made clear, “the recovery” is entirely the artifact of the understated measure of inflation used to deflate nominal GDP. By under-measuring inflation, the government can show low, but positive, rates of real GDP growth. No other indicator supports the claim of economic recovery.

Consumer Inflation is now 9%

John Williams writes that consumer inflation, if properly measured, is running around 9%, far above the 2% figure that is the Fed’s target and more in line with what consumers are actually experiencing. We have just had a 6.5% annual increase in the cost of a postage stamp.

The Postcard Test

The Fed’s target inflation rate is said to be low, but Simon Black points out that the result of a lifetime of 2% annual inflation is the loss of 75% of the purchasing power of the currency. He uses the cost of sending a postcard to illustrate the decline in the purchasing power of median household income today compared to 1951. That year it cost one cent to send a post card. As household income was $4,237, the household could send 423,700 postcards. Today the comparable income figure is $51,017. As it costs 34 cents to send one postcard, today’s household can only afford to send 150,050 postcards. Nominal income rose 12 times, and the cost of sending a postcard rose 34 times.

Just as the American people know that there is more inflation than is reported, they know that there is no recovery. The Gallup Poll reported this month that only 28% of Americans are satisfied with the economy. http://www.gallup.com/poll/166871/americans-satisfaction-economy-sours-2001.aspx?version=print

Secret TPP Treaty Will Enable Corporations to Further Loot America

From hard experience, Americans have also caught on that “free trade agreements” are nothing but vehicles for moving their jobs abroad. The latest effort by the corporations to loot and defraud the public is known as the “Trans-Pacific Partnership.” “Fast-tracking” the bill allowed the corporations to write the bill in secret without congressional input. Some research shows that 90% of Americans will suffer income losses under TPP, while wealth becomes even more concentrated at the top.

TPP affects every aspect of our lives from what we eat to the Internet to the environment. According to Kevin Zeese in Alternet, “the leak of the [TPP] Intellectual Property Chapter revealed that it created a path to patent everything imaginable, including plants and animals, to turn everything into a commodity for profit.”

The secretly drafted TPP also creates authority for the executive branch to change existing US law to make the laws that were not passed in secret compatible with the secretly written trade bill. Buy American requirements and any attempt to curtail jobs offshoring would become illegal “restraints on trade.”

If the House and Senate are willing to turn over their legislative function to the executive branch, they might as well abolish themselves.

The “Cypress Model” Coming Sooner Than You Thought

The financial media has been helping the Federal Reserve and the banks to cover up festering problems with rosy hype, but realization that there are serious unresolved problems might be spreading. Last week interest rates on 30-day T-bills turned negative. That means people were paying more for a bond than it would return at maturity. Dave Kranzler sees this as a sign of rising uncertainty about banks. Reminiscent of the Cyprus banks’ limits on withdrawals, last Friday (January 24) the BBC reported that the large UK bank HSBC is preventing customers from withdrawing cash from their accounts in excess of several thousand pounds. Click Here to read report.

If and when uncertainty spreads to the dollar, the real crisis will arrive, likely followed by high inflation, exchange controls, pension confiscations, and resurrected illegality of owning gold and silver. Capitalist greed aided and abetted by economists and policymakers will have destroyed America.

Roberts, Kranzler, Blow Lid Off Gold Manipulation by Federal Reserve

The Hows and Whys of Gold Price Manipulation

By: Paul Craig Roberts and Dave Kranzler

January 17, 2014

visit www.paulcraigroberts.org for more

The deregulation of the financial system during the Clinton and George W. Bush regimes had the predictable result: financial concentration and reckless behavior. A handful of banks grew so large that financial authorities declared them “too big to fail.” Removed from market discipline, the banks became wards of the government requiring massive creation of new money by the Federal Reserve in order to support through the policy of Quantitative Easing the prices of financial instruments on the banks’ balance sheets and in order to finance at low interest rates trillion dollar federal budget deficits associated with the long recession caused by the financial crisis.

The deregulation of the financial system during the Clinton and George W. Bush regimes had the predictable result: financial concentration and reckless behavior. A handful of banks grew so large that financial authorities declared them “too big to fail.” Removed from market discipline, the banks became wards of the government requiring massive creation of new money by the Federal Reserve in order to support through the policy of Quantitative Easing the prices of financial instruments on the banks’ balance sheets and in order to finance at low interest rates trillion dollar federal budget deficits associated with the long recession caused by the financial crisis.

The Fed’s policy of monetizing one trillion dollars of bonds annually put pressure on the US dollar, the value of which declined in terms of gold. When gold hit $1,900 per ounce in 2011, the Federal Reserve realized that $2,000 per ounce could have a psychological impact that would spread into the dollar’s exchange rate with other currencies, resulting in a run on the dollar as both foreign and domestic holders sold dollars to avoid the fall in value. Once this realization hit, the manipulation of the gold price moved beyond central bank leasing of gold to bullion dealers in order to create an artificial market supply to absorb demand that otherwise would have pushed gold prices higher. The manipulation consists of the Fed using bullion banks as its agents to sell naked gold shorts in the New York Comex futures market. Short selling drives down the gold price, triggers stop-loss orders and margin calls, and scares participants out of the gold trusts. The bullion banks purchase the deserted shares and present them to the trusts for redemption in bullion. The bullion can then be sold in the London physical gold market, where the sales both ratify the lower price that short-selling achieved on the Comex floor and provide a supply of bullion to meet Asian demands for physical gold as opposed to paper claims on gold.

Tonnage of Gold is moving to Asia

The evidence of gold price manipulation is clear. In this article we present evidence and describe the process. We conclude that ability to manipulate the gold price is disappearing as physical gold moves from New York and London to Asia, leaving the West with paper claims to gold that greatly exceed the available supply.

The primary venue of the Fed’s manipulation activity is the New York Comex exchange, where the world trades gold futures. Each gold futures contract represents one gold 100 ounce bar. The Comex is referred to as a paper gold exchange because of the use of these futures contracts. Although several large global banks are trading members of the Comex, JP Morgan, HSBC and Bank Nova Scotia conduct the majority of the trading volume. Trading of gold (and silver) futures occurs in an auction-style market on the floor of the Comex daily from 8:20 a.m. to 1:30 p.m. New York time. Comex futures trading also occurs on what is known as Globex. Globex is a computerized trading system used for derivatives, currency and futures contracts. It operates continuously except on weekends. Anyone anywhere in the world with access to a computer-based futures trading platform has access to the Globex system.

In addition to the Comex, the Fed also engages in manipulating the price of gold on the far bigger–in terms of total dollar value of trading–London gold market. This market is called the LBMA (London Bullion Marketing Association) market. It is comprised of several large banks who are LMBA market makers known as “bullion banks” (Barclays, Credit Suisse, Deutsche Bank, Goldman Sachs, HSBC, JPMorganChase, Merrill Lynch/Bank of America, Mitsui, Societe Generale, Bank of Nova Scotia and UBS). Whereas the Comex is a “paper gold” exchange, the LBMA is the nexus of global physical gold trading and has been for centuries. When large buyers like Central Banks, big investment funds or wealthy private investors want to buy or sell a large amount of physical gold, they do this on the LBMA market.

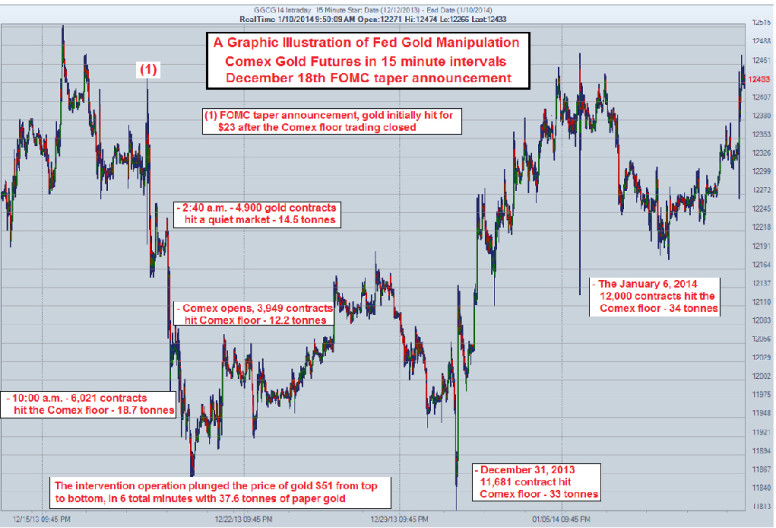

1.2 Million Ounces of Gold in less than 60 seconds

The Fed’s gold manipulation operation involves exerting forceful downward pressure on the price of gold by selling a massive amount of Comex gold futures, which are dropped like bombs either on the Comex floor during NY trading hours or via the Globex system. A recent example of this occurred on Monday, January 6, 2014. After rallying over $15 in the Asian and European markets, the price of gold suddenly plunged $35 at 10:14 a.m. In a space of less than 60 seconds, more than 12,000 contracts traded – equal to more than 10% of the day’s entire volume during the 23 hour trading period in which which gold futures trade. There was no apparent news or market event that would have triggered the sudden massive increase in Comex futures selling which caused the sudden steep drop in the price of gold. At the same time, no other securities market (other than silver) experienced any unusual price or volume movement. 12,000 contracts represents 1.2 million ounces of gold, an amount that exceeds by a factor of three the total amount of gold in Comex vaults that could be delivered to the buyers of these contracts.

This manipulation by the Fed involves the short-selling of uncovered Comex gold futures. “Uncovered” means that these are contracts that are sold without any underlying physical gold to deliver if the buyer on the other side decides to ask for delivery. This is also known as “naked short selling.” The execution of the manipulative trading is conducted through one of the major gold futures trading banks, such as JPMorganChase, HSBC, and Bank of Nova Scotia. These banks do the actual selling on behalf of the Fed. The manner in which the Fed dumps a large quantity of futures contracts into the market differs from the way in which a bona fide trader looking to sell a big position would operate. The latter would try to work off his position carefully over an extended period of time with the goal of trying to disguise his selling and to disturb the price as little as possible in order to maximize profits or minimize losses. In contrast, the Fed‘s sales telegraph the intent to drive the price lower with no regard for preserving profits or fear or incurring losses, because the goal is to inflict as much damage as possible on the price and intimidate potential buyers.

Globex System Manipulated by Fed

The Fed also actively manipulates gold via the Globex system. The Globex market is punctuated with periods of “quiet” time in which the trade volume is very low. It is during these periods that the Fed has its agent banks bombard the market with massive quantities of gold futures over a very brief period of time for the purpose of driving the price lower. The banks know that there are very few buyers around during these time periods to absorb the selling. This drives the price lower than if the selling operation occurred when the market is more active.

The Fed also actively manipulates gold via the Globex system. The Globex market is punctuated with periods of “quiet” time in which the trade volume is very low. It is during these periods that the Fed has its agent banks bombard the market with massive quantities of gold futures over a very brief period of time for the purpose of driving the price lower. The banks know that there are very few buyers around during these time periods to absorb the selling. This drives the price lower than if the selling operation occurred when the market is more active.

A primary example of this type of intervention occurred on December 18, 2013, immediately after the FOMC announced its decision to reduce bond purchases by $10 billion monthly beginning in January 2014. With the rest of the trading world closed, including the actual Comex floor trading, a massive amount of Comex gold futures were sold on the Globex computer trading system during one of its least active periods. This selling pushed the price of gold down $23 dollars in the space of two hours. The next wave of futures selling occurred in the overnight period starting at 2:30 a.m. NY time on December 19th. This time of day is one of the least active trading periods during any 23 hour trading day (there’s one hour when gold futures stop trading altogether). Over 4900 gold contracts representing 14.5 tonnes of gold were dumped into the Globex system in a 2-minute period from 2:40-2:41 a.m, resulting in a $24 decline in the price of gold. This wasn’t the end of the selling. Shortly after the Comex floor opened later that morning, another 1,654 contracts were sold followed shortly after by another 2,295 contracts. This represented another 12.2 tonnes of gold. Then at 10:00 a.m. EST, another 2,530 contracts were unloaded on the market followed by an additional 3,482 contracts just six minutes later. These sales represented another 18.7 tonnes of gold.

All together, in 6 minutes during an eight hour period, a total amount of 37.6 tonnes (a “tonne” is a metric ton–about 10% more weight than a US ”ton”) of gold future contracts were sold. The contracts sold during these 6 minutes accounted for 10% of the total volume during that 23 hours period of time. Four-tenths of one percent of the trading day accounted for 10% of the total volume. The gold represented by the futures contracts that were sold during these 6 minutes was a multiple of the amount of physical gold available to Comex for delivery.

The purpose of driving the price of gold down was to prevent the announced reduction in bond purchases (the so-called tapering) from sending the dollar, stock and bond markets down. The markets understand that the liquidity that Quantitative Easing provides is the reason for the high bond and stock prices and understand also that the gains from the rising stock market discourage gold purchases. Previously when the Fed had mentioned that it might reduce bond purchases, the stock market fell and bonds sold off. To neutralize the market scare, the Fed manipulated both gold and stock markets. (See Pam Martens for explanation of the manipulation of the stock market: http://wallstreetonparade.com/2013/12/why-didn’t-the-stock-market-sell-off-on-the-fed’s-taper-announcement/ )

While the manipulation of the gold market has been occurring since the start of the bull market in gold in late 2000, this pattern of rampant manipulative short-selling of futures contracts has been occurring on a more intense basis over the last 2 years, during gold’s price decline from a high of $1900 in September 2011. The attack on gold’s price typically will occur during one of several key points in time during the 23 hour Globex trading period. The most common is right at the open of Comex gold futures trading, which is 8:20 a.m. New York time. To set the tone of trading, the price of gold is usually knocked down when the Comex opens. Here are the other most common times when gold futures are sold during illiquid Globex system time periods:

– 6:00 p.m NY time weekdays, when the Globex system re-opens after closing for an hour;

– 6:00 p.m. Sunday evening NY time when Globex opens for the week;

– 2:30 a.m. NY time, when Shanghai Gold Exchange closes

– 4:00 a.m. NY time, just after the morning gold “fix” on the London gold market (LBMA);

2:00 p.m. NY time any day but especially on Friday, after the Comex floor trading has closed – it’s an illiquid Globex-only session and the rest of the world is still closed.

In addition to selling futures contracts on the Comex exchange in order to drive the price of gold lower, the Fed and its agent bullion banks also intermittently sell large quantities of physical gold in London’s LBMA gold market. The process of buying and selling actual physical gold is more cumbersome and complicated than trading futures contracts. When a large supply of physical gold hits the London market all at once, it forces the market a lot lower than an equivalent amount of futures contracts would. As the availability of large amounts of physical gold is limited, these “physical gold drops” are used carefully and selectively and at times when the intended effect on the market will be most effective.

The primary purpose for short-selling futures contracts on Comex is to protect the dollar’s value from the growing supply of dollars created by the Fed’s policy of Quantitative Easing. The Fed’s use of gold leasing to supply gold to the market in order to reduce the rate of rise in the gold price has drained the Fed’s gold holdings and is creating a shortage in physical gold. Historically most big buyers would leave their gold for safe-keeping in the vaults of the Fed, Bank of England or private bullion banks rather than incur the cost of moving gold to local depositories. However, large purchasers of gold, such as China, now require actual delivery of the gold they buy.

Demands for gold delivery have forced the use of extraordinary and apparently illegal tactics in order to obtain physical gold to settle futures contracts that demand delivery and to be able to deliver bullion purchased on the London market (LBMA). Gold for delivery is obtained from opaque Central Bank gold leasing transactions, from “borrowing” client gold held by the bullion banks like JP Morgan in their LBMA custodial vaults, and by looting the gold trusts, such as GLD, of their gold holdings by purchasing large blocks of shares and redeeming the shares for gold.

Central Bank gold leasing occurs when Central Banks take physical gold they hold in custody and lease it to bullion banks. The banks sell the gold on the London physical gold market. The gold leasing transaction makes available physical gold that can be delivered to buyers in quantities that would not be available at existing prices. The use of gold leasing to manipulate the price of gold became a prevalent practice in the 1990’s. While Central Banks admit to engaging in gold lease transactions, they do not admit to its purpose, which is to moderate rises in the price of gold, although Fed Chairman Alan Greenspan did admit during Congressional testimony on derivatives in 1998 that “Central banks stand ready to lease gold in increasing quantities should the price rise.”

Another method of obtaining bullion for sale or delivery is known as “rehypothecation.” Rehypothecation occurs when a bank or brokerage firm “borrows” client assets being held in custody by banks. Technically, bank/brokerage firm clients sign an agreement when they open an account in which the assets in the account might be pledged for loans, like margin loans. But the banks then take pledged assets and use them for their own purpose rather than the client’s. This is rehypothecation. Although Central Banks fully disclose the practice of leasing gold, banks/brokers do not publicly disclose the details of their rehypothecation activities.

Over the course of the 13-year gold bull market, gold leasing and rehypothecation operations have largely depleted most of the gold in the vaults of the Federal Reserve, Bank of England, European Central Bank and private bullion banks such as JPMorganChase. The depletion of vault gold became a problem when Venezuela was the first country to repatriate all of its gold being held by foreign Central Banks, primarily the Fed and the BOE. Venezuela’s request was provoked by rumors circulating the market that gold was being leased and hypothecated in increasing quantities. About a year later, Germany made a similar request. The Fed refused to honor Germany’s request and, instead, negotiated a seven year timeline in which it would ship back 300 of Germany’s 1500 tonnes. This made it apparent that the Fed did not have the gold it was supposed to be holding for Germany.

Why does the Fed need seven years in which to return 20 percent of Germany’s gold? The answer is that the Fed does not have the gold in its vault to deliver. In 2011 it took four months to return Venezuela’s 160 tonnes of gold. Obviously, the gold was not readily at hand and had to be borrowed, perhaps from unsuspecting private owners who mistakenly believe that their gold is held in trust.

Paper Claims to Actual Gold: 93 to 1

Western central banks have pushed fractional gold reserve banking to the point that they haven’t enough reserves to cover withdrawals. Fractional reserve banking originated when medieval goldsmiths learned that owners of gold stored in their vault seldom withdrew the gold. Instead, those who had gold on deposit circulated paper claims to gold. This allowed goldsmiths to lend gold that they did not have by issuing paper receipts. This is what the Fed has done. The Fed has created paper claims to gold that does not exist in physical form and sold these claims in mass quantities in order to drive down the gold price. The paper claims to gold are a large multiple of the amount of actual gold available for delivery. The Reserve Bank of India reports that the ratio of paper claims to gold exceed the amount of gold available for delivery by 93:1.

Fractional reserve systems break down when too many depositors or holders of paper claims present them for delivery. Breakdown is occurring in the Fed’s fractional bullion operation. In the last few years the Asian markets–specifically and especially the Chinese–are demanding actual physical delivery of the bullion they buy. This has created a sense of urgency among the Fed, Treasury and the bullion banks to utilize any means possible to flush out as many weak holders of gold as possible with orchestrated price declines in order to acquire physical gold that can be delivered to Asian buyers

The $650 decline in the price of gold since it hit $1900 in September 2011 is the result of a manipulative effort designed both to protect the dollar from Quantitative Easing and to free up enough gold to satisfy Asian demands for delivery of gold purchases.

Around the time of the substantial drop in gold’s price in April, 2013, the Bank of England’s public records showed a 1300 tonne decline in the amount of gold being held in the BOE bullion vaults. This is a fact that has not been denied or reasonably explained by BOE officials despite several published inquiries. This is gold that was being held in custody but not owned by the Bank of England. The truth is that the 1300 tonnes is gold that was required to satisfy delivery demands from the large Asian buyers. It is one thing for the Fed or BOE to sell, lease or rehypothecate gold out of their vault that is being safe-kept knowing the entitled owner likely won’t ask for it anytime soon, but it is another thing altogether to default on a gold delivery to Asians demanding delivery.

Default on delivery of purchased gold would terminate the Federal Reserve’s ability to manipulate the gold price. The entire world would realize that the demand for gold greatly exceeds the supply, and the price of gold would explode upwards. The Federal Reserve would lose control and would have to abandon Quantitative Easing. Otherwise, the exchange value of the US dollar would collapse, bringing to an end US financial hegemony over the world.

Last April, the major takedown in the gold price began with Goldman Sachs issuing a “technical analysis” report with an $850 price target (gold was around $1650 at that time). Goldman Sachs also broadcast to every major brokerage firm and hedge fund in New York that gold was going to drop hard in price and urged brokers to get their clients out of all physical gold holdings and/or shares in physical gold trusts like GLD or CEF. GLD and CEF are trusts that purchase physical gold/silver bullion and issue shares that represent claims on the bullion holdings. The shares are marketed as investments in gold, but represent claims that can only be redeemed in very large blocks of shares, such as 100,000, and perhaps only by bullion banks. GLD is the largest gold ETF (exchange traded firm), but not the only one. The purpose of Goldman Sachs’ announcement was to spur gold sales that would magnify the price effect of the short-selling of futures contracts. Heavy selling of futures contracts drove down the gold price and forced sales of GLD and other ETF shares, which were bought up by the bullion banks and redeemed for gold

At the beginning of 2013, GLD held 1350 tonnes of gold. By April 12th, when the heavy intervention operation began, GLD held 1,154 tonnes. After the series of successive raids in April, the removal of gold from GLD accelerated and currently there are 793 tonnes left in the trust. In a little more than one year, more than 41% of the gold bars held by GLD were removed – most of that after the mid-April intervention operation.

In addition, the Bank of England made its gold available for purchase by the bullion banks in order to add to the ability to deliver gold to Asian purchasers.

The financial media, which is used to discredit gold as a safe haven from the printing of fiat currencies, claims that the decline in GLD’s physical gold is an indication that the public is rejecting gold as an investment. In fact, the manipulation of the gold price downward is being done systematically in order to coerce holders of GLD to unload their shares. This enables the bullion banks to accumulate the amount of shares required to redeem gold from the GLD Trust and ship that gold to Asia in order to meet the enormous delivery demands. For example, in the event described above on January 6th, 14% of GLD’s total volume for the day traded in a 1-minute period starting at 10:14 a.m. The total volume on the day for GLD was almost 35% higher than the average trading volume in GLD over the previous ten trading days

Before 2013, the amount of gold in the GLD vault was one of the largest stockpiles of gold in the world. The swift decline in GLD’s gold inventory is the most glaring indicator of the growing shortage of physical gold supply that can be delivered to the Asian market and other large physical gold buyers. The more the price of gold is driven down in the Western paper gold market, the higher the demand for physical bullion in Asian markets. In addition, several smaller physical gold ETFs have experienced substantial gold withdrawals. Including the more than 100 tonnes of gold that has disappeared from the Comex vaults in the last year, well over 1,000 tonnes of gold has been removed from the various ETFs and bank custodial vaults in the last year. Furthermore, there is no telling how much gold that is kept in bullion bank private vaults on behalf of wealthy investors has been rehypothecated. All of this gold was removed in order to avoid defaulting on delivery demands being imposed by Asian commercial, investment and sovereign gold buyers.

The Federal Reserve seems to be trapped. The Fed is creating approximately 1,000 billion new US dollars annually in order to support the prices of debt related derivatives on the books of the few banks that have been declared to be “to big to fail” and in order to finance the large federal budget deficit that is now too large to be financed by the recycling of Chinese and OPEC trade surpluses into US Treasury debt. The problem with Quantitative Easing is that the annual creation of an enormous supply of new dollars is raising questions among American and foreign holders of vast amounts of US dollar-denominated financial instruments. They see their dollar holdings being diluted by the creation of new dollars that are not the result of an increase in wealth or GDP and for which there is no demand

Quantitative Easing is a threat to the dollar’s exchange value. The Federal Reserve, fearful that the falling value of the dollar in terms of gold would spread into the currency markets and depreciate the dollar, decided to employ more extreme methods of gold price manipulation.

When gold hit $1,900, the Federal Reserve panicked. The manipulation of the gold price became more intense. It became more imperative to drive down the price, but the lower price resulted in higher Asian demand for which scant supplies of gold were available to meet.

Having created more paper gold claims than there is gold to satisfy, the Fed has used its dependent bullion banks to loot the gold exchange traded funds (ETFs) of gold in order to avoid default on Asian deliveries. Default would collapse the fractional bullion system that allows the Fed to drive down the gold price and protect the dollar from QE.

What we are witnessing is our central bank pulling out all stops on integrity and lawfulness in order to serve a small handful of banks that financial deregulation allowed to become “too big to fail” at the expense of our economy and our currency. When the Fed runs out of gold to borrow, to rehypothecate, and to loot from ETFs, the Fed will have to abandon QE or the US dollar will collapse and with it Washington’s power to exercise hegemony over the world.

Dave Kranzler traded high yield bonds for Bankers Trust for a decade. As a co-founder and principal of Golden Returns Capital LLC, he manages the Precious Metals Opportunity Fund. Click Here to go to his website.

Federal Judge Blasts Government, Justice System For Failure To Prosecute Banksters

Why Have No High Level Executives Been Prosecuted In Connection With The Financial Crisis?

By Jed S. Rakoff November 15, 2013

The following comes to us from the Honorable Judge Jed S. Rakoff, who sits in the U.S. District Court for the Southern District of New York. Judge Rakoff is also an adjunct professor at Columbia Law School. Re-posted from the Columbia Law School blog.

Five years have passed since the onset of what is sometimes called the Great Recession. While the economy has slowly improved, there are still millions of Americans leading lives of quiet desperation: without jobs, without resources, without hope.

Who was to blame? Was it simply a result of negligence, of the kind of inordinate risk-taking commonly called a “bubble,” of an imprudent but innocent failure to maintain adequate reserves for a rainy day? Or was it the result, at least in part, of fraudulent practices, of dubious mortgages portrayed as sound risks and packaged into ever-more-esoteric financial instruments, the fundamental weaknesses of which were intentionally obscured?

If it was the former – if the recession was due, at worst, to a lack of caution – then the criminal law has no role to play in the aftermath. For, in all but a few circumstances (not here relevant), the fierce and fiery weapon called criminal prosecution is directed at intentional misconduct, and nothing less. If the Great Recession was in no part the handiwork of intentionally fraudulent practices by high-level executives, then to prosecute such executives criminally would be “scapegoating” of the most shallow and despicable kind.

Failure of the Criminal Justice System

But if, by contrast, the Great Recession was in material part the product of intentional fraud, the failure to prosecute those responsible must be judged one of the more egregious failures of the criminal justice system in many years. Indeed, it would stand in striking contrast to the increased success that federal prosecutors have had over the past 50 years or so in bringing to justice even the highest level figures who orchestrated mammoth frauds. Thus, in the 1970′s, in the aftermath of the “junk bond” bubble that, in many ways, was a precursor of the more recent bubble in mortgage-backed securities, the progenitors of the fraud were all successfully prosecuted, right up to Michael Milken. Again, in the 1980′s, the so-called savings-and-loan crisis, which again had some eerie parallels to more recent events, resulted in the successful criminal prosecution of more than 800 individuals, right up to Charles Keating. And, again, the widespread accounting frauds of the 1990′s, most vividly represented by Enron and WorldCom, led directly to the successful prosecution of such previously respected C.E.O.’s as Jeffrey Skilling and Bernie Ebbers.

Not a Single High Level Executive Has Been Successfully Prosecuted

In striking contrast with these past prosecutions, not a single high level executive has been successfully prosecuted in connection with the recent financial crisis, and given the fact that most of the relevant criminal provisions are governed by a five-year statute of limitations, it appears very likely that none will be. It may not be too soon, therefore, to ask why.

One possibility, already mentioned, is that no fraud was committed. This possibility should not be discounted. Every case is different, and I, for one, have no opinion as to whether criminal fraud was committed in any given instance.

FBI Warnings Ignored

But the stated opinion of those government entities asked to examine the financial crisis overall is not that no fraud was committed. Quite the contrary. For example, the Financial Crisis Inquiry Commission, in its final report, uses variants of the word “fraud” no fewer than 157 times in describing what led to the crisis, concluding that there was a “systemic breakdown,” not just in accountability, but also in ethical behavior. As the Commission found, the signs of fraud were everywhere to be seen, with the number of reports of suspected mortgage fraud rising 20-fold between 1998 and 2005 and then doubling again in the next four years. As early as 2004, FBI Assistant Director Chris Swecker, was publicly warning of the “pervasive problem” of mortgage fraud, driven by the voracious demand for mortgage-backed securities. Similar warnings, many from within the financial community, were disregarded, not because they were viewed as inaccurate, but because, as one high level banker put it, “A decision was made that ‘We’re going to have to hold our nose and start buying the product if we want to stay in business.’”

Without multiplying examples, the point is that, in the aftermath of the financial crisis, the prevailing view of many government officials (as well as others) was that the crisis was in material respects the product of intentional fraud. In a nutshell, the fraud, they argued, was a simple one. Subprime mortgages, i.e., mortgages of dubious creditworthiness, increasingly provided the sole collateral for highly-leveraged securities that were marketed as triple-A, i.e., of very low risk. How could this transformation of a sow’s ear into a silk purse be accomplished unless someone dissembled along the way?

While officials of the Department of Justice have been more circumspect in describing the roots of the financial crisis than have the various commissions of inquiry and other government agencies, I have seen nothing to indicate their disagreement with the widespread conclusion that fraud at every level permeated the bubble in mortgage-backed securities. Rather, their position has been to excuse their failure to prosecute high level individuals for fraud in connection with the financial crisis on one or more of three grounds:

Justice Department Excuses

First, they have argued that proving fraudulent intent on the part of the high level management of the banks and companies involved has proved difficult. It is undoubtedly true that the ranks of top management were several levels removed from those who were putting together the collateralized debt obligations and other securities offerings that were based on dubious mortgages; and the people generating the mortgages themselves were often at other companies and thus even further removed. And I want to stress again that I have no opinion as to whether any given top executive had knowledge of the dubious nature of the underlying mortgages, let alone fraudulent intent. But what I do find surprising is that the Department of Justice should view the proving of intent as so difficult in this context. Who, for example, were generating the so-called “suspicious activity” reports of mortgage fraud that, as mentioned, increased so hugely in the years leading up to the crisis? Why, the banks themselves. A top level banker, one might argue, confronted with increasing evidence from his own and other banks that mortgage fraud was increasing, might have inquired as to why his bank’s mortgage-based securities continued to receive triple-A ratings? And if, despite these and other reports of suspicious activity, the executive failed to make such inquiries, might it be because he did not want to know what such inquiries would reveal?

This, of course, is what is known in the law as “willful blindness” or “conscious disregard.” It is a well-established basis on which federal prosecutors have asked juries to infer intent, in cases involving complexities, such as accounting treatments, at least as esoteric as those involved in the events leading up to the financial crisis. And while some federal courts have occasionally expressed qualifications about the use of the willful blindness approach to prove intent, the Supreme Court has consistently approved it. As that Court stated most recently in Global-Tech Appliances, Inc. v. SEB S.A., 131 S.Ct. 2060, 2068 (2011), “The doctrine of willful blindness is well established in criminal law. Many criminal statutes require proof that a defendant acted knowingly or willfully, and courts applying the doctrine of willful blindness hold that defendants cannot escape the reach of these statutes by deliberately shielding themselves from clear evidence of critical facts that are strongly suggested by the circumstances.” Thus, the Department’s claim that proving intent in the financial crisis context is particularly difficult may strike some as doubtful.

Second, and even weaker, the Department of Justice has sometimes argued that, because the institutions to whom mortgage-backed securities were sold were themselves sophisticated investors, it might be difficult to prove reliance. Thus, in defending the failure to prosecute high level executives for frauds arising from the sale of mortgage-backed securities, the then head of the Department of Justice’s Criminal Division, told PBS that “in a criminal case … I have to prove not only that you made a false statement but that you intended to commit a crime, and also that the other side of the transaction relied on what you were saying. And frankly, in many of the securitizations and the kinds of transactions we’re talking about, in reality you had very sophisticated counter-parties on both sides. And so even though one side may have said something was dark blue when really we can say it was sky blue, the other side of the transaction, the other sophisticated party, wasn’t relying at all on the description of the color.”

Actually, given the fact that these securities were bought and sold at lightning speed, it is by no means obvious that even a sophisticated counter-party would have detected the problems with the arcane, convoluted mortgage-backed derivatives they were being asked to purchase. But there is a more fundamental problem with the above-quoted statement from the former head of the Criminal Division, which is that it totally misstates the law. In actuality, in a criminal fraud case the Government is never required to prove reliance, ever. The reason, of course, is that would give a crooked seller a license to lie whenever he was dealing with a sophisticated counter-party. The law, however, says that society is harmed when a seller purposely lies about a material fact, even if the immediate purchaser does not rely on that particular fact, because such misrepresentations create problems for the market as a whole. And surely there never was a situation in which the sale of dubious mortgage-backed securities created more of a huge problem for the marketplace, and society as a whole, than in the recent financial crisis.

“Too Big To Jail” Excuse is Disturbing

The third reason the Department has sometimes given for not bringing these prosecutions is that to do so would itself harm the economy. Thus, Attorney General Holder himself told Congress that “it does become difficult for us to prosecute them when we are hit with indications that if we do prosecute – if we do bring a criminal charge – it will have a negative impact on the national economy, perhaps even the world economy.” To a federal judge, who takes an oath to apply the law equally to rich and to poor, this excuse — sometimes labeled the “too big to jail” excuse – is disturbing, frankly, in what it says about the Department’s apparent disregard for equality under the law.

In fairness, however, Mr. Holder was referring to the prosecution of financial institutions, rather than their C.E.O.’s. Moreover, he might have also been influenced, as his Department unquestionably was, by the adverse reaction to the Arthur Anderson case, where that accounting firm was run out of business by a prosecution that was ultimately reversed on appeal. But if we are talking about prosecuting individuals, the excuse becomes entirely irrelevant; for no one that I know of has ever contended that a big financial institution would collapse if one or more of its high level executives were prosecuted, as opposed to the institution itself.

Without multiplying examples further, my point is that the Department of Justice has never taken the position that all the top executives involved in the events leading up to the financial crisis were innocent, but rather has offered one or another excuse for not criminally prosecuting them – excuses that, on inspection, appear unconvincing. So, you might ask, what’s really going on here? I don’t claim to have any inside information about the real reasons why no such prosecutions have been brought, but I take the liberty of offering some speculations, for your consideration or amusement as the case may be.

At the outset, however, let me say that I totally discount the argument sometimes made that no such prosecutions have been brought because the top prosecutors were often people who previously represented the financial institutions in question and/or were people who expected to be representing such institutions in the future: the so-called “revolving door.” In my experience, every federal prosecutor, at every level, is seeking to make a name for him-or-herself, and the best way to do that is by prosecuting some high level person. While companies that are indicted almost always settle, individual defendants whose careers are at stake will often go to trial. And if the Government wins such a trial, as it usually does, the prosecutor’s reputation is made. My point is that whatever small influence the “revolving door” may have in discouraging certain white-collar prosecutions is more than offset, at least in the case of prosecuting high-level individuals, by the career-making benefits such prosecutions confer on the successful prosecutor.

So, one asks again, why haven’t we seen such prosecutions growing out of the financial crisis? I offer, by way of speculation, three influences that I think, along with others, have had the effect of limiting such prosecutions.

1,000 FBI Agents Re-Assigned From Financial Fraud to 9-11 Investigation

First, the prosecutors had other priorities. Some of these were completely understandable. For example, prior to 2001, the FBI had more than 1,000 agents assigned to investigating financial frauds, but after 9/11 many of these agents were shifted to anti-terrorism work. Who can argue with that? Eventually, it is true, new agents were hired for some of the vacated spots in fraud detection; but this is not a form of detection easily learned and recent budget limitations have only exacerbated the problem.

Of course, the FBI is not the primary investigator of fraud in the sale of mortgage-backed securities; that responsibility lies mostly with the S.E.C. But at the very time the financial crisis was breaking, the S.E.C. was trying to deflect criticism from its failure to detect the Madoff fraud, and this led it to concentrate on other Ponzi-like schemes, which for awhile were, along with accounting frauds, its chief focus. More recently, the S.E.C. has been hard hit by budget limitations, and this has not only made it more difficult to assign the kind of manpower the kinds of frauds we are talking about require, but also has led S.E.C. enforcement to focus on the smaller, easily resolved cases that will beef up their statistics when they go to Congress begging for money.

As for the Department of Justice proper, a decision was made around 2009 to spread the investigation of these financial fraud cases among numerous U.S. Attorney’s Offices, many of which had little or no prior experience in investigating and prosecuting sophisticated financial frauds. At the same time, the U.S. Attorney’s Office with the greatest expertise in these kinds of cases, the Southern District of New York, was just embarking on its prosecution of insider trading cases arising from the Rajaratnam tapes, which soon proved a gold mine of good cases that absorbed a huge amount of the attention of the securities fraud unit of that office. While I want to stress again that I have no inside information, as a former chief of that unit I would venture to guess that the cases involving the financial crisis were parceled out to Assistants who also had insider trading cases. Which do you think an Assistant would devote most of her attention to: an insider trading case that was already nearly ready to go to indictment and that might lead to a high visibility trial, or a financial crisis case that was just getting started, would take years to complete, and had no guarantee of even leading to an indictment? Of course, she would put her energy into the insider trading case, and if she was lucky, it would go to trial, she would win, and she would then take a job with a large law firm. And in the process, the financial fraud case would get lost in the shuffle.

Alternative priorities, in short, is, I submit, one of the reasons the financial fraud cases were not brought, especially cases against high level individuals that would take many years, many investigators, and a great deal of expertise to investigate. But a second, and less salutary, reason for not bringing such cases is the Government’s own involvement in the underlying circumstances that led to the financial crisis.

Government Itself Created the Conditions – Glass-Steagall Repealed

On the one hand, the government, writ large, had a hand in creating the conditions that encouraged the approval of dubious mortgages. Even before the start of the housing boom, it was the government, in the form of Congress, that repealed Glass-Steagall, thus allowing certain banks that had previously viewed mortgages as a source of interest income to become instead deeply involved in securitizing pools of mortgages in order to obtain the much greater profits available from trading. It was the government, in the form of both the executive and the legislature, that encouraged deregulation, thus weakening the power and oversight not only of the S.E.C. but also of such diverse banking overseers as the O.T.S. and the O.C.C. It was the government, in the form of the Fed, that kept interest rates low in part to encourage mortgages. It was the government, in the form of the executive, that strongly encouraged banks to make loans to low-income persons who might have previously been regarded as too risky to warrant a mortgage. It was the government, in the form of the government-sponsored entities known as Fannie Mae and Freddie Mac, that helped create the fora- time insatiable market for mortgage-backed securities. And it was the government, pretty much across the board, that acquiesced in the ever greater tendency not to require meaningful documentation as a condition of obtaining a mortgage, often preempting in this regard state regulations designed to assure greater mortgage quality and a borrower’s ability to repay.

The result of all this was the mortgages that later became known as “liars’ loans.” They were increasingly risky; but what did the banks care, since they were making their money from the securitizations; and what did the government care, since they were helping to boom the economy and helping voters to realize their dream of owning a home.

Government Forced Mergers

Moreover, the government was also deeply enmeshed in the aftermath of the financial crisis. It was the government that proposed the shotgun marriages of Bank of America with Merrill Lynch, of J.P. Morgan with Bear Stearns, etc. If, in the process, mistakes were made and liabilities not disclosed, was it not partly the government’s fault?

Please do not misunderstand me. I am not alleging that the Government knowingly participated in any of the fraudulent practices alleged by the Financial Inquiry Crisis Commission and others. But what I am suggesting is that the Government was deeply involved, from beginning to end, in helping create the conditions that could lead to such fraud, and that this would give a prudent prosecutor pause in deciding whether to indict a C.E.O. who might, with some justice, claim that he was only doing what he fairly believed the Government wanted him to do.

Shift From Prosecuting High-Level Individuals to Prosecuting Corporations

The final factor I would mention is both the most subtle and the most systemic of the three, and arguably the most important, and it is the shift that has occurred over the past 30 years or more from focusing on prosecuting high-level individuals to focusing on prosecuting companies and other institutions. It is true that prosecutors have brought criminal charges against companies for well over a hundred years, but, until relatively recently, such prosecutions were the exception, and prosecutions of companies without simultaneous prosecutions of their managerial agents were even rarer. The reasons were obvious. Companies do not commit crimes; only their agents do. And while a company might get the benefit of some such crimes, prosecuting the company would inevitably punish, directly or indirectly, the many employees and shareholders who were totally innocent. Moreover, under the law of most U.S. jurisdictions, a company cannot be criminally liable unless at least one managerial agent has committed the crime in question; so why not prosecute the agent who actually committed the crime?

In recent decades, however, prosecutors have been increasingly attracted to prosecuting companies, often even without indicting a single individual. This shift has often been rationalized as part of an attempt to transform “corporate cultures,” so as to prevent future such crimes; and, as a result, it has taken the form of “deferred prosecution agreements” or even “non-prosecution agreements,” in which the company, under threat of criminal prosecution, agrees to take various prophylactic measures to prevent future wrongdoing. But in practice, I suggest, it has led to some lax and dubious behavior on the part of prosecutors, with deleterious results.

If you are a prosecutor attempting to discover the individuals responsible for an apparent financial fraud, you go about your business in much the same way you go after mobsters or drug kingpins: you start at the bottom and, over many months or years, slowly work your way up. Specifically, you start by “flipping” some lower or mid-level participant in the fraud whom you can show was directly responsible for making one or more false material misrepresentations but who is willing to cooperate, and maybe even “wear a wire” (i.e. secretly record his colleagues), in order to reduce his sentence. With his help, and aided by the substantial prison penalties now available in white collar cases, you go up the ladder. For a detailed example of how this works, I recommend Kurt Eichenwald’s well-known book The Informant, which describes how FBI agents, over a period of three years, uncovered the huge price-fixing conspiracy involving high-level executives at Archer Daniels, all of whom were successfully prosecuted.

But if your priority is prosecuting the company, a different scenario takes place. Early in the investigation, you invite in counsel to the company and explain to him or her why you suspect fraud. He or she responds by assuring you that the company wants to cooperate and do the right thing, and to that end the company has hired a former Assistant U.S. Attorney, now a partner at a respected law firm, to do an internal investigation. The company’s counsel asks you to defer your investigation until the company’s own internal investigation is completed, on the condition that the company will share its results with you. In order to save time and resources, you agree. Six months later the company’s counsel returns, with a detailed report showing that mistakes were made but that the company is now intent on correcting them. You and the company then agree that the company will enter into a deferred prosecution agreement that couples some immediate fines with the imposition of expensive but internal prophylactic measures. For all practical purposes the case is now over. You are happy because you believe that you have helped prevent future crimes; the company is happy because it has avoided a devastating indictment; and perhaps the happiest of all are the executives, or former executives, who actually committed the underlying misconduct, for they are left untouched.

I suggest that this is not the best way to proceed. Although it is supposedly justified in terms of preventing future crimes, I suggest that the future deterrent value of successfully prosecuting individuals far outweighs the prophylactic benefits of imposing internal compliance measures that are often little more than window-dressing. Just going after the company is also both technically and morally suspect. It is technically suspect because, under the law, you should not indict or threaten to indict a company unless you can prove beyond a reasonable doubt that some managerial agent of the company committed the alleged crime; and if you can prove that, why not indict the manager? And from a moral standpoint, punishing a company and its many innocent employees and shareholders for the crimes committed by some unprosecuted individuals seems contrary to elementary notions of moral responsibility.

These criticisms take on special relevance, however, in the instance of investigations growing out of the financial crisis, because, as noted, the Department of Justice’s position, until at least very recently, is that going after the suspect institutions poses too great a risk to the nation’s economic recovery. So you don’t go after the companies, at least not criminally, because they are too big to jail; and you don’t go after the individuals, because that would involve the kind of years-long investigations that you no longer have the experience or the resources to pursue

In conclusion, I want to stress again that I have no idea whether the financial crisis that is still causing so many of us so much pain and despondency was the product, in whole or in part, of fraudulent misconduct. But if it was — as various governmental authorities have asserted it was –- then, the failure of the government to bring to justice those responsible for such colossal fraud bespeaks weaknesses in our prosecutorial system that need to be addressed.

The Federal Reserve: 100 Years of Deceit and Corruption

It’s Time For the Government to Seize the Federal Reserve and Make it a Public Utility

by Ellen Brown

December 23rd, 2013, marks the 100th anniversary of the Federal Reserve, warranting a review of its performance. Has it achieved the purposes for which it was designed?

The answer depends on whose purposes we are talking about. For the banks, the Fed has served quite well. For the laboring masses whose populist movement prompted it, not much has changed in a century.

Thwarting Populist Demands

The Federal Reserve Act was passed in 1913 in response to a wave of bank crises, which had hit on average every six years over a period of 80 years. The resulting economic depressions triggered a populist movement for monetary reform in the 1890s. Mary Elizabeth Lease, an early populist leader, said in a fiery speech that could have been written today:

Wall Street owns the country. It is no longer a government of the people, by the people, and for the people, but a government of Wall Street, by Wall Street, and for Wall Street. The great common people of this country are slaves, and monopoly is the master. . . . Money rules . . . .Our laws are the output of a system which clothes rascals in robes and honesty in rags. The parties lie to us and the political speakers mislead us. . . .

We want money, land and transportation. We want the abolition of the National Banks, and we want the power to make loans direct from the government. We want the foreclosure system wiped out.

That was what they wanted, but the Federal Reserve Act that they got was not what the populists had fought for, or what their leader William Jennings Bryan thought he was approving when he voted for it in 1913. In the stirring speech that won him the Democratic presidential nomination in 1896, Bryan insisted:

[We] believe that the right to coin money and issue money is a function of government. . . . Those who are opposed to this proposition tell us that the issue of paper money is a function of the bank and that the government ought to go out of the banking business. I stand with Jefferson . . . and tell them, as he did, that the issue of money is a function of the government and that the banks should go out of the governing business.

You shall not press down upon the brow of labor this crown of thorns, you shall not crucify mankind upon a cross of gold.